Tag:

The IRS says that taxpayers will have to reimburse certain credits in a new alert

The IRS commissioner urges the declarants to be wary of tax professionals in bad faith and "doubtful credits".

The IRS represses complaints pending taxpayers: "deeply concerned"

The IRS commissioner says that the declarants were misleading by thinking that they are "eligible for a big salary".

IRS admits a major error because taxpayers who have paid in full are informed that they must be more

These letters are not a scam, but may contain a disinformation on your income declaration in 2023.

How to get the tax credit in 2024 EV and save big on an electric car

This could revise your balance sheets significantly.

Irs says that "well -intentioned" taxpayers have fraudulently filed 3 complaints: "they were deceived"

The agency reports thousands of taxpayers with "inappropriate" reimbursement complaints.

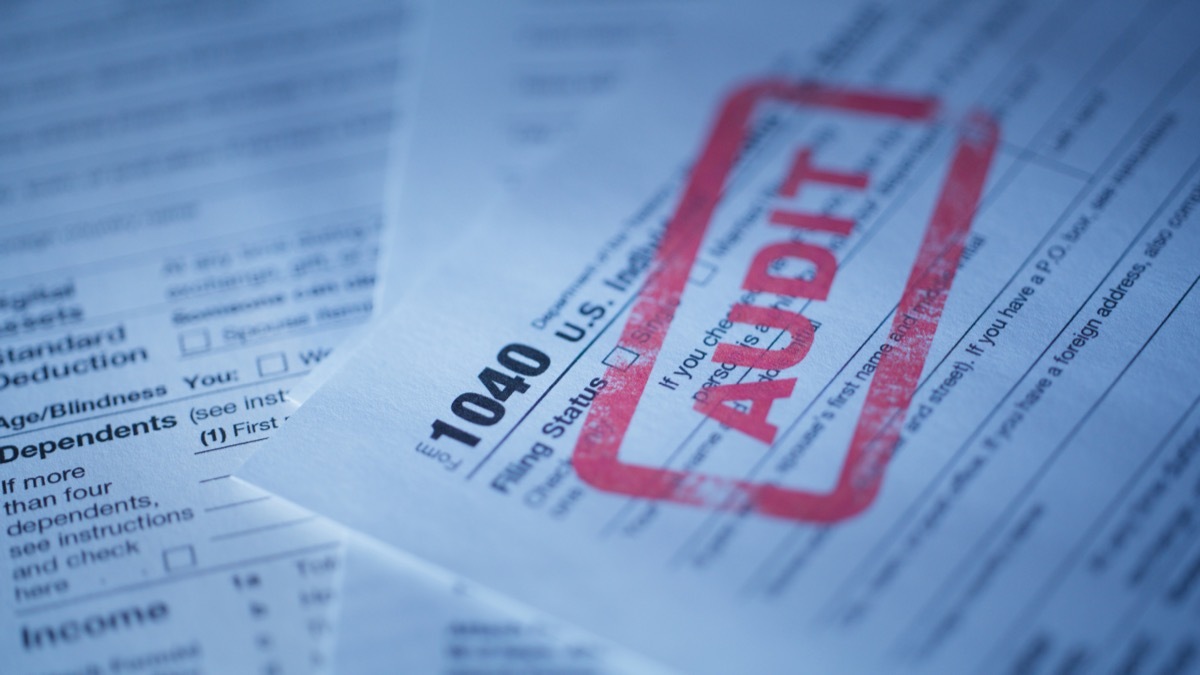

The IRS claims that the audits are about to go up and the sharing that will be targeted

The audit rates are set in Triple, warns the agency.

Irs says that you have until May 17 to obtain non -claimed reimbursements: "money on the table"

The agency has more than a billion dollars in unin demanded compensation.

6 warnings concerning the filing of a tax extension, according to experts

Here is what can happen when you don't get your documents by the deadline.

IRS data shows exactly to what extent you are likely

Your chances can be higher or lower depending on your income, as well as other factors.

The IRS warns against the deposit by mail while the tax deadline is looming - here is why

The agency urges people to "choose an electronic deposit as far as possible".

The IRS issues a new urgent warning to preparers of "shaded" income declarations

They can steal all of your reimbursement as well as your identity, says the agency.

The IRS warns against the "elaborate scam" to steal your tax refund in a new alert

The agency says that thieves can try to rob your online account by offering to help.

The IRS issues a final reminder for nearly a million tax reimbursements: "The time is exhausted"

The agency says it is the last chance to claim more than a billion dollars that remains.

11 things you need to do to "avoid income declaration errors," said the IRS in a new alert

Make sure to keep these tips in mind before the deadline for deposit next month.

The IRS issues a new warning to the expenses' complaint: "Taxpayers should be careful"

If you have an FSA or HSA, you will want to pay particular attention to this opinion.

The IRS issues a final recall for claiming payment of the revival - are you eligible?

The tax agency claims that the deadline to take advantage of the advantage is approaching.

10 warnings on the use of turbotax, according to experts

Here is what you need to know before using this popular software to deposit with IRS.

I am an accountant and these are my 5 warnings of tax deposit for retirees

Seniors may want to keep these tips in mind before sending their information to the IRS.

The IRS issues a new alert in 5 major tax changes that you need to know before depositing

Not following the constantly evolving tax rules could cause steep penalties.

New warning on fraudulent tax reimbursements: "These checks are false"

A woman in Pennsylvania speaks after being at the reception of a potential scam.

The deposit of your taxes later could increase your reimbursement, but the IRS warns against it

The agency says that it is always better to send your information as soon as possible.

The tax expert reveals why you should deposit "as soon as you can"

Sending everything at IRS as soon as possible can save you sorrow.

The accountants reveal "surprise" tax errors that cost you big and how to avoid them

Be aware of these during the taxation year of 2024, warn the financial experts.

I am an accountant and here is why I never deposit my online taxes

You may want to revisit postal mail for your 2023 income declaration.

Ex-worker warns that Turbotax "tries to make your taxes more difficult"

The former employee also gives free suggestions that you can file this year.

Irs issues a new alert in 5 things that you should declare on your taxes this year

The agency sends a new reminder to help you avoid a penalty.

The IRS warns that 20% of taxpayers do not claim the major reimbursement credit - are you eligible?

The tax agency urges the declarants to reveal this often neglected opportunity.

Irs issues a new alert with 7 key dates for taxpayers - and the first is tomorrow

Submissions of the 2023 tax season are officially open to treatment.

6 tax errors that could make you audited, according to financial experts

There are several risk factors that could lead to a sequence with the IRS.

The new IRS alert means surprise reimbursements for many Americans - do you get one?

The agency claims to grant a penalty sentence of nearly five million income statements.