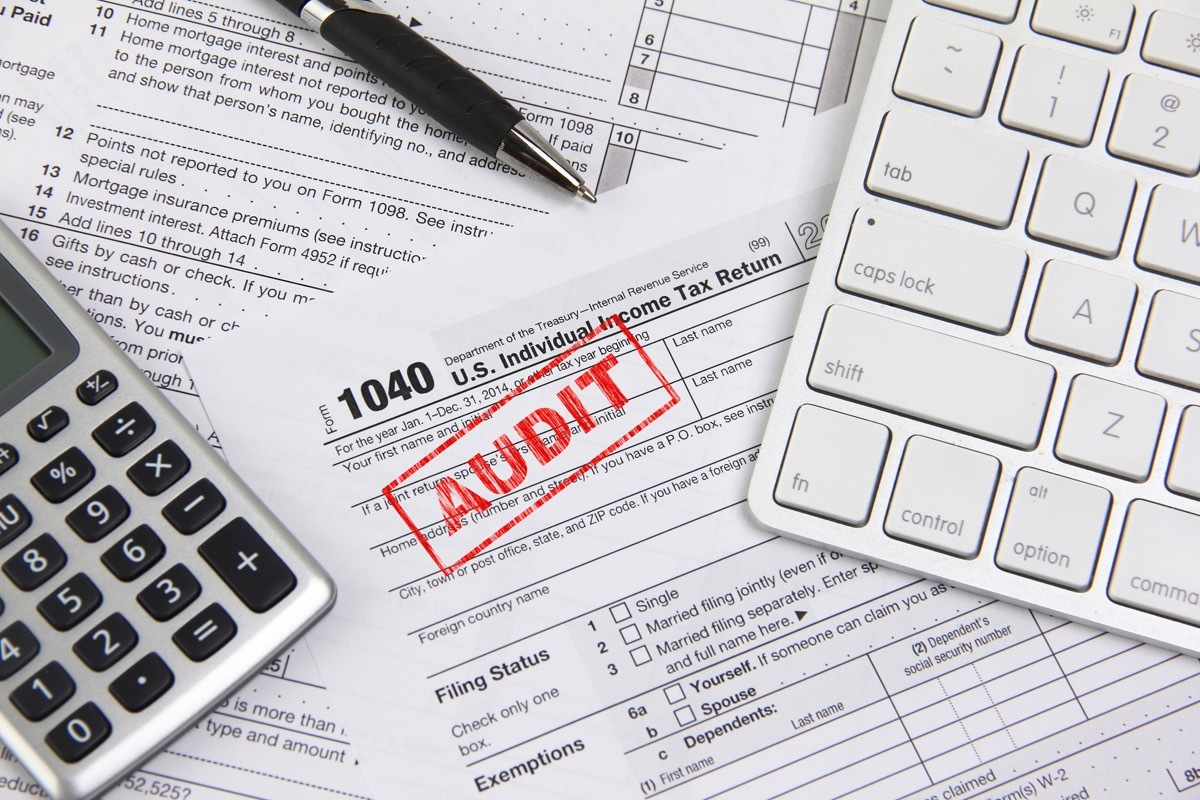

6 tax errors that could make you audited, according to financial experts

There are several risk factors that could lead to a sequence with the IRS.

Maybe the only thing worse than compile your taxes each year is to discover that you are checked after all your hard work. Fortunately, there are a lot of services and Software options This can help you avoid potential headaches or expensive fines, even if you are in a time crisis. But if you are looking for a better idea of how to avoid a race with IRS, there are a few things to remember before depositing. Read the rest for the reasons for being checked this year, according to experts in finance.

In relation: The IRS announces important changes in income tax declaration for next year - are you assigned?

6 reasons to be checked for this year's taxes

1. You have badly declared your income.

The deposit of your taxes can be relatively simple if you are dealing with a single pay check. But if you have a complicated financial situation with multiple income flows, you can land in hot water if you do not pay attention while filling out the forms.

"The IRS uses a program to match what has been reported to the IRS of employers, banks, brokerage and other sources compared to what you have reported in your income declaration. If there is With one difference, it could open you to an audit, "said Robert Farrington , founder and CEO of The college investor .

"So, make sure that you are precisely entering all your information from these W2S, 1099 and other forms to avoid an audit. If there is an error on one of them, you must work with the one who Delivered to resolve it, "he says.

2. Your income has changed from year to year.

Whether it is a job change or an unforeseen financial emergency, everyone has good and bad exercises. However, significant changes in income can also cause a more in -depth examination of civil servants.

"If your income increases and decreases each year, the IRS might want to know more about the reasons why it does this," Riley Adams , founder and CEO of Wealth , tell Better life . "It may be because you ask for different credits and deductions each year, your income is not consistent, or perhaps something else."

But that does not necessarily mean that you should pigeon your income. "You are not penalized to have a dynamic income, but compared to income tax declarations with a stable taxable income from year to year, that certainly highlights your return," explains Adams. "If this is only part of your normal income and nothing ordinary, you should not sweat: life has its ups and downs, just like your income."

"As always, be sure to document everything, provide tax positions supported to your declaration and possibly check with a professional if you have any questions," he suggests.

In relation: 4 warnings on the use of turbotax, according to experts .

3. You are generous with deductions.

Logan Allec , a CPA and owner of the tax relief company Choice of tax relief , said he saw customers be audited if they overestimated their deductions against their income. Whether it is an attempt to lower your tax obligation or an innocent error, this could increase a red flag with the IRS.

"The IRS deals with millions of income tax declarations similar to yours each year, and therefore it knows how much the charitable contributions, say, are a typical range for taxpayers similar to you," said Alc. "But if the amount of your charitable contributions is far beyond this range, it could trigger an audit."

Michael Hammelburger , the CEO and a financial expert working for The group of bass , recommends keeping recordings, receipts and detailed documents for all the deductions that you plan to claim. "It is essential to be transparent and to deduct only legitimate expenses," he notes.

Read this then: 4 warnings on the use of turbotax, according to experts .

4. You put it bad for your business.

Entrepreneurs know that the tax deposit for a personal company often requires a Outdoor professional To ensure that everything is managed correctly. Otherwise, it could end up becoming a reason for a more in -depth investigation.

"If you have a concert or a business, there are many things that could trigger an audit," warns Farrington. "For example, excessive deductions or depreciation that does not make sense to your business. Or unusual losses that could indicate that the company is a hobby and not a business."

He adds: "You must realize that the IRS has millions of commercial returns, data points, and even more to see if your business is" normal "or not. So, whether you claim items in your income tax return , you must be able to prove that expenses were ordinary and necessary during business. "

Moira Corcoran , A accountant And a tax expert at Justanswer, adds that round figures can also be a red flag for an audit: "If you store the same $ 8,000 for marketing, $ 5,000 for legal or $ 3,000 for travel, 'Irs knows that you do not add legitimate deductions. "

5. You make a lot of money.

According to experts, earning a lot of money could put you more at risk of potential audit.

"If you make a big income and you think that paying your fair taxes will be enough to keep the IRS on your back, you could be surprised," said Adams. "You may very well be right, but if you try to become cute and claim tax credits and deductions focused on high income, but hurt it, you can expect the IRS to hit Your door, but not literally, because they are usually generally send something by post. "

"The IRS has more to win by examining a taxpayer with high income than for someone who earns less. So, they will be more likely to verify that you have sprinkled your i and cross your T," explains Adams.

"Make sure to check, then to dismiss - what you claim from your declaration before classifying it. You will want to know that you do not apply a lot of the tax positions that you think will reduce your taxable income, but will eventually cause more headache than expected, "he suggests.

In relation: 6 secrets of accounting income tax declaration .

6. You were the victim of a scam.

Even the IRS is not immune to the scams. In fact, at the beginning of the year, the agency published its 2023 Dirty Dozen Campaign , an annual list of common scams targeting taxpayers.

"There are many ways to obtain good tax information, including a trustworthy professional, tax software and IRS.GOV. But people should be incredibly suspicious On the follow -up of shared advice on social networks, "IRS commissioner Danny Werfel said in a press release at the time. "Remember that if it seems too good to be true, this is probably the case," he added.

For example, in March, the IRS had warned against Two scams circulating on social networks : Form 8944 Fraud and W-2 Fraud form. "The two programs encourage people to submit false and inaccurate information in the hope of obtaining a refund," said the agency.

Later this month, the agency warned the public on another scam in which third parties promoted a Fraudulent fuel tax credit .

"The fuel tax credit is intended for the use of companies and off -road agriculture and, as such, is not available for most taxpayers," said the agency in a Press release. "However, preparers and unscrupulous appointments attract taxpayers to inflate their reimbursements by wrongly demanding credit. ""

And in all these cases, it could be found with an audit - or even worse. "Taxpayers who intentionally deposit forms with false or fraudulent information can face serious consequences, including potentially civil and criminal sanctions," IRS said in its alert.

To avoid an audit or more serious costs, always consult the list of dozens of Dirty if you have doubts.

In relation: 5 warnings concerning the use of the free IRS file for your taxes, according to experts in finance .

Being audited may not be the fault on your part.

No matter your situation, there can happen a point where the confusing process for preparing and filing your taxes surprises you. But even if you have managed to do everything, you could always be contacted by the authorities. AE0FCC31AE342FD3A1346EBB1F342FCB

"Remember that an audit does not necessarily mean that you have done something wrong," said Farrington. "The IRS makes an" audit ", which means checking everything you have pointed out."

In addition, the IRS randomly selects taxpayers for audits each year. "Sometimes the yields are selected only on a statistical formula. We compare your income declaration with" standards "for similar yields. We develop these" standards "from the audits of a statistically valid yield random sample, in The framework of the National Research Program The IRS conducts program. The IRS uses this program to update return selection information, "the agency Explain on his website .

And an audit is not always found in penalties. "I saw certain cases of audits in favor of the taxpayer, which means that IRS had in fact a more important reimbursement after everything was verified," explains Farrington. "This is why the important part is to keep specific records and documents."

For more financial advice delivered directly in your reception box, Register for our daily newsletter .

Best Life offers the most recent financial information of high -level experts and latest news and research, but our content is not supposed to replace professional advice. Regarding the money you spend, save or invest, always consult your financial advisor directly.

If you have this frozen food at home, throw it now, the USDA says

The fall excursion you should take, depending on your zodiac sign