The IRS says that taxpayers will have to reimburse certain credits in a new alert

The IRS commissioner urges the declarants to be wary of tax professionals in bad faith and "doubtful credits".

Although a high investment, renewable resources are a winner-win for you and the environment. Solar panels and wind turbines prevent air pollution and the production of harmful emissions such as greenhouse gases. In addition, the transition to clean energy technologies can put money back into your pocket thanks to a tax incentive called residential clean energy credit (RCEC). Unfortunately for some taxpayers, RCEC is the last target of the The continuous increase in tax scams . In a July 3 press release , the Internal Revenue Service (IRS) urged declarants "not to be victims of a new emerging scam involving the purchase of own energy tax credits".

In relation: The IRS represses complaints in suspense of taxpayers: "deeply concerned".

THE RCEC clearly indicates The fact that taxpayers who "invest in renewable energies for [their] house such as solar energy, wind, geothermal energy, fuel cells or batteries storage" can be eligible for non -refundable credit.

As for what this implies, the IRS claims that the RCEC "is equivalent to 30% of the costs of new qualified clean energy properties for your house installed at any time from 2022 to 2032. 2033 and 22% for goods placed in service in 2034. "

On the surface, these tax credits may seem very attractive. However, in the case of RCEc, the IRS warns that "the preparers of unscrupulous income declarations distort the rules to claim clean energy credits under the Act on the Reduction of Inflation (IRA)" .

“People buying tax credits under IRA are subject to passive activity rules for any purchased credit. tax responsibility. AE0FCC31AE342FD3A1346EBB1F342FCB

In relation: IRS admits a major error because taxpayers who have paid in full are informed that they must be more .

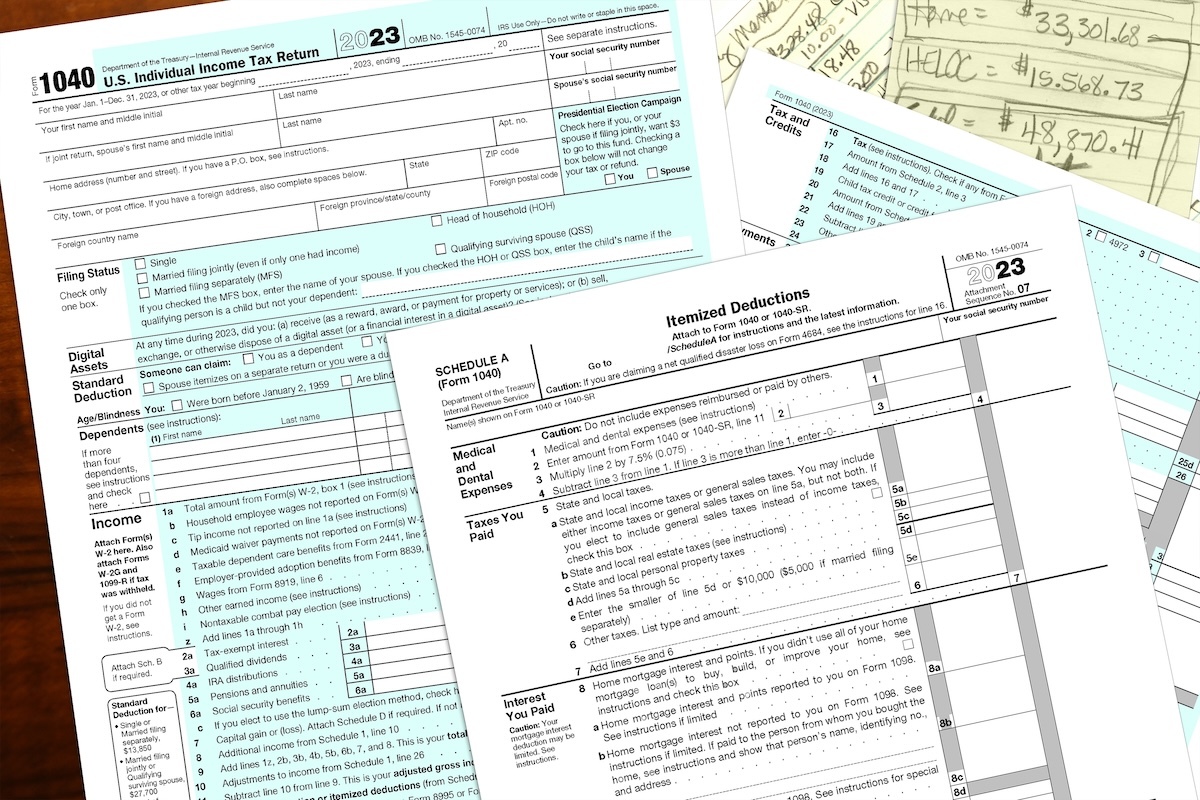

The crooks mainly target taxpayers who submit form 1040, which collects information concerning income, deductions, tax reimbursements and credits. In this specific regime, the IRS has received yields in which income tax has been reduced by using fraudulent app.

In the consumer alert, the IRS said that affected taxpayers will be penalized for citing ineligible credits and required to reimburse the inflated credit in addition to interest and other possible costs.

"This is another example where crooks try to use the complexity of the tax law to encourage people to claim credits to which they are not entitled," said the IRS commissioner Danny Werfel . "Taxpayers should be wary of promoters pushing doubtful credits like this and others. The IRS watches over this scam, and we urge people to use a renowned taxation before claiming complex credits like clean energy . "

Those who wish to know more about RCEC or think that they are legally eligible to buy clean energy credits in IRA directives should not ask advice from trust tax experts.

Farmer finds abandoned kittens and decides to caress them but quickly realizes a staggering truth about them!