The IRS announces 401K and changes in the tax tranche for next year - are you assigned?

Your deposit for the 2024 taxation year might seem a little different because of these updates.

For many people, one of the first main elements on the list of tasks of the new year is to prepare their tax return and send to the Rété Service internal (IRS). But if you are the type that like to take measures To prepare as soon as possible, January is also time to start organizing and planning for 2024. And even if you do not expect important life events that could modify your next preparation, the IRS has already announced Changes to 401 (K) Limits and tax slices for next year. Read the rest to see if you are assigned by updates when you go to the file in 2025.

In relation: The IRS warns that the complaint of these credits can provide you with audit and a fine .

People often use 401 (K) and I will save saving for retirement.

The establishment of a 401 (K) is one of the most common ways that people plan for retirement. The single plan allows workers to store a Set up the amount of income - and potentially even that their employers correspond to it - which remains not in shape in a defined amount, according to the Personal Nerdwallet finance website.

Those who do not have access to a 401 (K) or who wish to diversify their savings can opt for an individual retirement account (IRA). But although these plans offer similar advantages, they have a much lower annual contribution limit and are relatively restrictive for those who have higher income, by Nerdwallet.

Although they differ from the structure, the two offer a significant tax advantage to people who seek to store funds later in life.

In relation: The IRS has just noted the standard deductions - will you have assigned?

The IRS has just announced some changes in the quantity of people who can make in these accounts for the 2024 taxation year.

If you have one of these retirement accounts in place, your tax file could be slightly different next year. In a press release on November 1, the IRS announced that it was Increase the amount That individuals can contribute to their 401 (K) per year, going from $ 22,500 in 2023 to $ 23,000 for the 2024 taxation year. The new limits also apply to 403 (B) and most of the 457 plans, as well as the savings plan for the federal government savings.

The limit of IRA contributions also increases for 2024. According to the agency, the amount will drop from $ 6,500 to $ 7,000.

This also adjusts the limits of the income beach for the traditional eligibility of IRA. Single taxpayers covered by a plan offered by the employer now have a higher deletion range, passing between $ 73,000 and $ 83,000 in $ 77,000 and $ 87,000 in 2024. The press release from the ' Agency contains different amounts for married couples jointly or separately.

In relation: 4 warnings on the use of turbotax, according to experts .

Your personal income determines the tax bracket in which you fall - and the rate you pay.

While all the United States which earns wages should pay its taxes, the amount they send the government changes on the basis How much they do . The IRS uses tax tranches with gradually higher rates to determine what is due to federal income tax, according to Nerdwallet. AE0FCC31AE342FD3A1346EBB1F342FCB

The rate that each supporting support is set by legislation, ventilation ranging from 10% to the lowest up to 37% for the highest employees. These figures will not change until 2025 after being created by law in 2017, according to Nerd Wallet.

Even if the percentages do not Different from year to year , the IRS regularly modifies the income tranches regularly. In fact, taxpayers in 2023 have already seen this change while the supports moved upwards by 7% compared to 2022 due to inflation, Forbes reported.

In relation: The IRS increases the sub -pairing penalties - how to avoid "giant costs" .

The latest IRS changes mean that your support could be different in 2024.

On November 9, the IRS announced that it had done Other inflation adjustments to federal tax tranches for 2024. The change has an increase of 5.4% compared to the previous year.

The lowest rate of 10% now applies to any individual taxpayers which earns $ 11,600 or less per year. It then increases to 12% for those who earn between $ 11,601 and $ 47,149, jump to 22% for those who earn between $ 47,150 and $ 100,524, and 24% for people who earn between $ 100,525 and $ 191,949.

The next support for taxpayers earning between $ 191,950 and $ 243,724 will pay 32%. Those who earn between $ 243,725 and $ 609,350 will pay 35%. Above this amount, taxpayers fall into the highest support of 37%. A ventilation of the supports for married couples jointly can be found in the opinion of the agency.

Best Life offers the most up -to -date financial information for high -level experts and latest news and research, but our content is not supposed to replace professional advice. Regarding the money you spend, save or invest, always consult your financial advisor directly.

In relation: For more information, register for our daily newsletter .

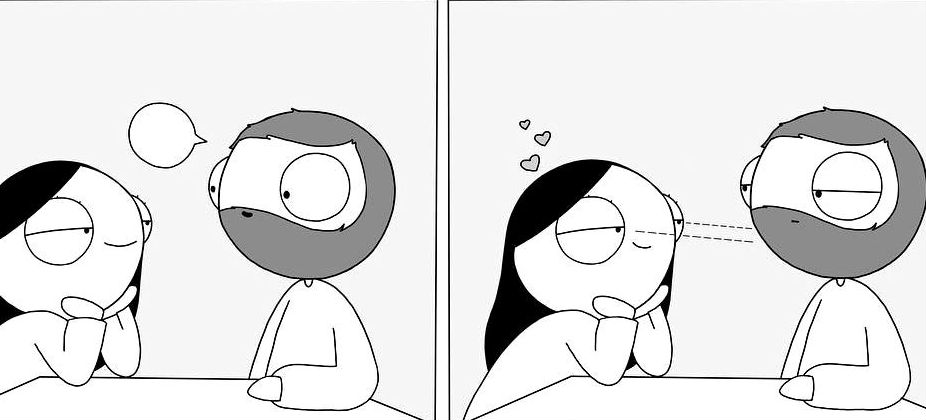

Girl secretly illustrates his life with BF, comics, and they go viral!