Chase customers say their accounts are suddenly closed

Four people showed claims regarding experiences.

The most of our money is managed electronically these days. We keep our savings of life hidden in Bank accounts , using wires, cards and even digital applications to transfer our funds when we have to make payments. And as we generally do not see money change hands with our own eyes, we must have a certain level of confidence in the companies with which we choose to banish. Unfortunately, the customers of a large banking institution now claim that their confidence has been moved. Some hunting customers say that their bank accounts have been suddenly closed. Continue reading to learn more.

In relation: Banks suddenly close accounts at the national level - here is how to protect your funds .

A woman says that her account was closed after a student loan refund.

To discover that your student loan debt has been forgiven would be a dream for many people. But for an Atlanta woman, he turned out to be a nightmare, local Abc-Affiliate WSB-TV Channel 2 reported on December 8 . White laws Tell the researcher for channel 2 consumption 2 Justin Gray that she received a letter from her federal student loan officers informing her that his debt had been forgiven, in parallel with a reimbursement check for the Trop-Payés.

But when White deposited the check for $ 5,298 in her Chase bank account by mobile deposit, she said that the institution had put a fraud restraint on the check and on her account. "Apparently, they could not verify that this check was real," she told Gray.

White said Chase finally closed her account and refused to move even after she returned to her loan agent to obtain a written confirmation of the validity of the reimbursement check.

"I went to the branch. I gave them this letter. I gave them this check, I gave them my ID my birth certificate, a social security card," she said. "I feel like a criminal, as if I had done something wrong."

Atlanta's wife said she had "always been able to" pay her bills in time but that she is now surfing because she can no longer access her money after Chase closed her account. However, Channel 2 contacted the banking company, and someone from the executive office contacted White a few hours later to say that they were looking for his case.

"We are working with our client and the US Treasury to check the funds it is due," a spokesperson for Chase to the press told.

In relation: Chase and Citi customers say their accounts are closed without warning .

Another customer says that Chase has held funds from the sale of his house for weeks.

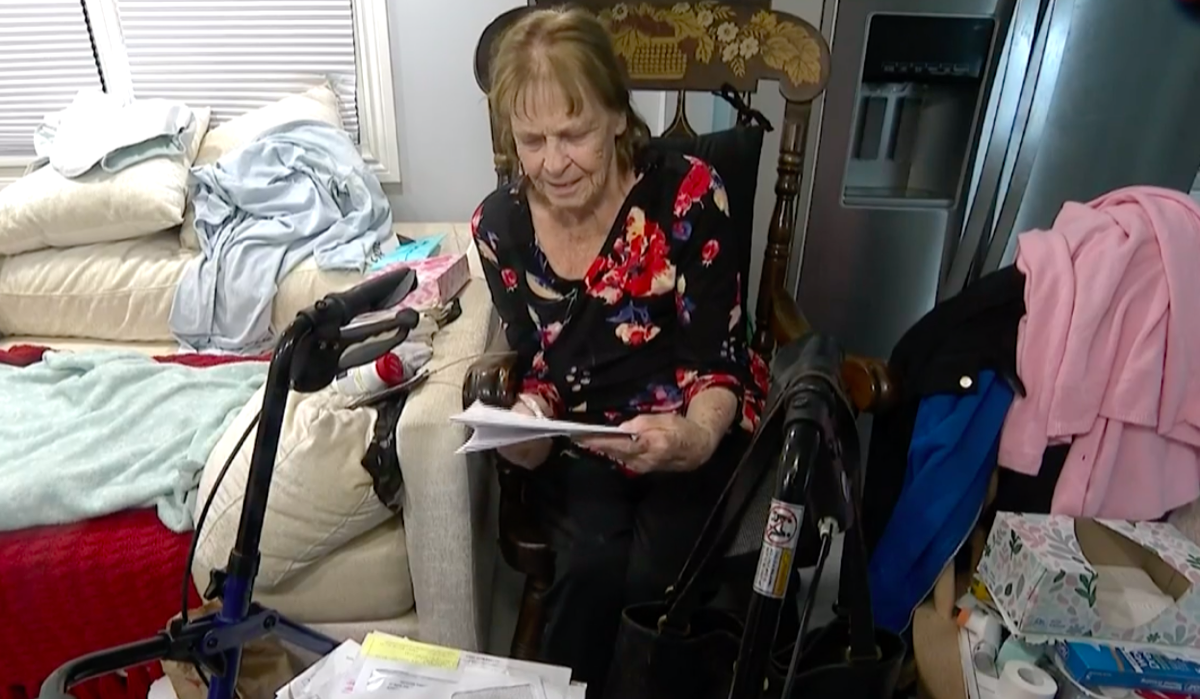

In March, an 80 -year -old woman from Amityville, New York, experienced similar problems trying to deposit a much larger sum of money, News12 the Bronx reported . Mary Smith received a check for $ 223,785.32 after sold his house in December to reduce the trailer in a trailer, and as Chase has no limit in dollars on ATM deposits, she deposited the check On his account in an automatic counter in the neighboring city of Merrick.

However, money has not entered his account. Chase initially said to Smith in a letter that they could not treat the check and return it within 10 days, but which then kept it for several weeks. "I felt terrible, terrible. I really needed money," she told News12.

With such a large quantity in limbo, Smith had to sleep on a sofa in her trailer because she had no money for furniture and she could barely afford food. "I had mayonnaise sandwiches! I had to borrow money from someone to pay my rent," she said.

Lawyer Charles Rosenblum , Managing partner of Krohn, Rosenblum & Rosenblum, worked Pro Bono for Smith to try to obtain answers from Chase and only after having filed a federal complaint with the office of the Currency Controller (OCS) hunted the check - months after Smith tried to drop him off.

When News12 contacted Chase, a spokesman said they were initially thought that there was a problem with the check, but would not explain what this problem was due to "confidentiality problems". The spokesperson also said that two months is the standard time for verification.

"We appreciate the patience of Ms. Smith," said Chase12’s spokesman for Chase12. "We strive to make sure that all the deposits are valid."

In relation: The USPS postal inspector reveals how to send checks to avoid flight .

Another woman made her account close after an employee error.

New Jersey resident Sheila Mallister also had Problems related to verification With Chase this year, The New York Times Report on December 9. She also organized her automotive bill with this account, and since direct deposits have taken time to treat, she wrote some checks from her former bank to her new pursuit in order to pay some of her larger invoices, such as rent and health insurance. AE0FCC31AE342FD3A1346EBB1F342FCB

Two days after making a distant deposit, the money had still not been erased on his account. Mallister therefore walked to his chase branch nearby in Westwood to ask for taking one of his checks to get up, but the worker accidentally deposited the same check on the Mallister account. "I thought that because the error was made by an employee of Chase, this problem will be solved quickly," she said The New York Times .

Instead, Mallister noted that his Chase account had been limited shortly after the error and was informed by the bank's climbing team that she was the subject of a fraud investigation. They did not tell her that the first problem had been solved, however, and that it was in fact her next check - which she wrote to herself - which had been reported because the writing looked suspect. Finally, Chase closed his account and said they had done so to avoid the potential losses of the bank.

"When we have concerns about the transactions of a client, we act in accordance with our compliance program," said a chase spokesperson The New York Times , adding that the action taken was "in accordance with our regulatory obligations".

A man was billed after Chase closed his account.

Another Chase client says he has been fighting with the bank for a year now. In 2022, YouTuber Bornalliance.com Download a video Explaining that Chase suddenly closed a current account he had had for almost 10 years for his business. "What is strange is that I don't even know what happened, and some of the bankers I spoke do not know what happened," he said . But even it was not the end of his problems with the company.

In a follow -up video Published this year On November 3, the Youtuber said that he had been affected by an "expense charge load" of $ 25 in Chase based on an automatic that he would have set up on the commercial account which was closed for a year previously. In other Update the video , He said that he had to enter a branch and five working days for the costs to be deleted.

But he also alerted the customers they had to be aware that they must manually suspend all automatic payments if they want to avoid being incorrectly invoiced by Chase. "Even if the account is closed, you can still be billed at the expense," said the Youtuber.

In relation: For more information, register for our daily newsletter .

The most shocking photos of Trump's supporters by taking clean up the American Capitol

Joel Mchale says he dislocated Chevy Chase's shoulder in a fight on the set