4 times, you should not enter information on your online credit card, say the experts

These red flags mean that you would better shop elsewhere.

You may not think twice before entering your credit card information online, but did you know that from 2023, a huge 65% of people with credit and debit cards were Victims of fraud At some point in their lives? This is an increase of 58% last year, which means that credit card scams are increasing. And although online purchases are safe, it also presents a major risk for these crimes. After all, pirates and thieves can commit fraud without physical access to your cards.

"Cybercriminals can use a variety of tactics to obtain your credit card information, such as phishing scams, malware and hacking on unmarked websites", explains LEVON L. GALSTYAN , an accountant certified to Oak View law group . "Once they have your credit card information, they can use it to make unauthorized purchases or even Fly your identity .

"The consequences of credit card fraud can be serious, including financial losses, Damaged credit scores , and even legal problems, "adds Gallstyan." It can be a long and complicated process to recover your money and erase your credit report, which is why prevention is crucial. ""

Although you cannot necessarily prevent your favorite retailers from undergoing unexpected data violations, keeping an eye on certain red flags can help protect your information. Continue to read to hear financial experts on the main times you should not enter your credit card information online.

Read this then: Never use automatically for these 6 invoices, according to financial experts .

4 times, you should not enter information from your credit card online

1. When you use unacceptable public wifi.

The next time you are tempted to buy something while dragging to Starbucks, the airport or at your local library, consider waiting for your return home.

Sejal-Lakhani Bhatt , cybersecurity expert and CEO of Techwerxe , says that making online shopping when using unsecured public wifi can make you vulnerable to hackers. Indeed, they can use the insecurity of these networks, then steal your credit card number, as well as other sensitive information, such as passwords of the account.

2. If the website does not have an SSL certificate.

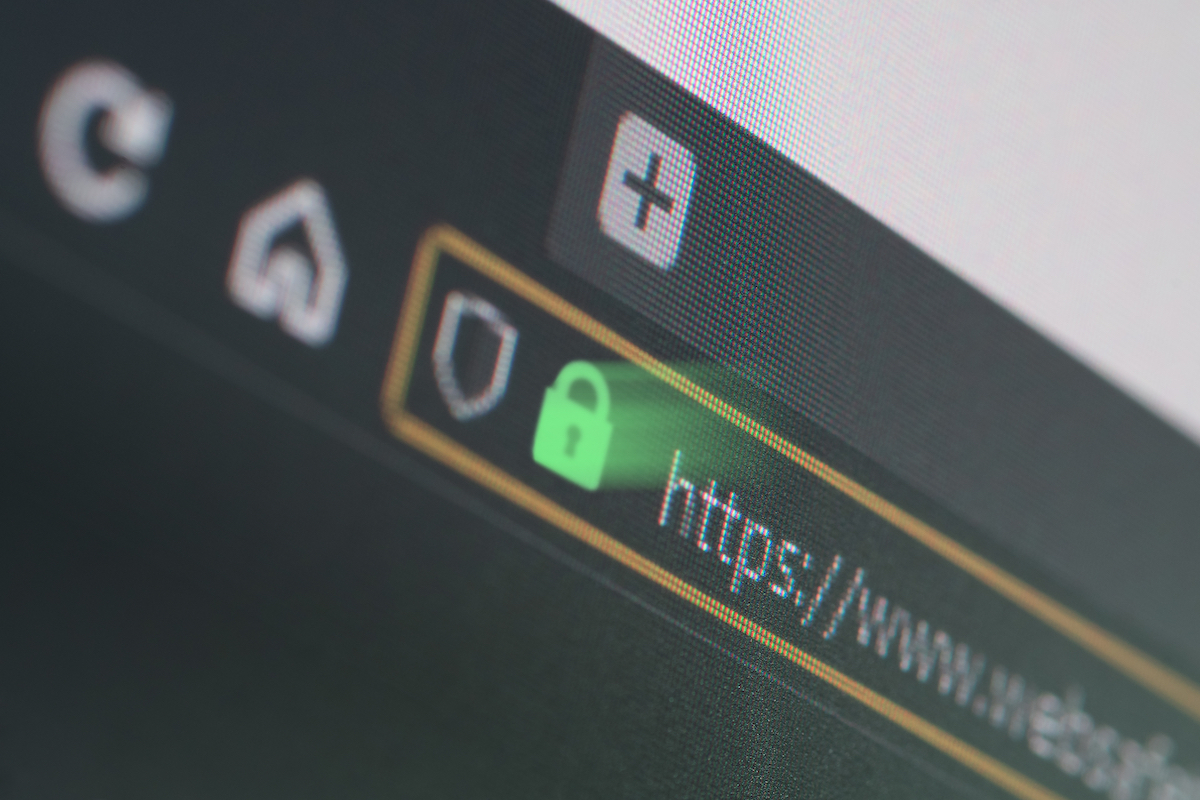

According Enoch Omololi , an expert in personal finance and founder of the blog New Invited Canadians , you should always check if the web address of a retailer starts with HTTPS. This additional "S" indicates that the store has an SSL certificate to protect customer information. Basically, even if a hacker has access to the data exchanged, he will not be able to use it to steal your identity or commit fraud because all the information is encrypted.

Another easy way to check if the website has an SSL certificate is to simply look for a green locking symbol on the left of the URL address bar.

When a site only shows HTTP at the start of the URL, and there is no green locking icon to be found, it means that the connection between your browser and the server is not encrypted, According to Gallstyan. This leaves your credit card information vulnerable to interception.

For more financial advice delivered directly in your reception box, Register for our daily newsletter .

3. If you receive suspect emails.

"Do not enter your credit card information on a website to which you have been led by a suspicious email," explains Gallstyan Better life .

"Phishing" is a common method that crooks and pirates use to encourage people to provide their credit card information. They will send you a message pretending to be a deemed company and will try to encourage you to click on a particular bond in the body of the email. For example, a phishing email could be able:

- Insist that you must have a balance on an invoice and you urge to make a payment

- Says there has been a suspicious activity in your account

- You offer a special affair or say that you are eligible for a refund

When you receive an email asking you to click on a link, be sure to recognize the sender. Even if the message seems to come from a business with which you have an account, it is always better to contact them directly rather than click on the link.

Read this then: Never use your credit card for these 6 purchases, according to financial experts . AE0FCC31AE342FD3A1346EBB1F342FCB

4. If the website seems basic.

It is important to always trust your intestine during online purchases.

"Usolating crooks sometimes cloning a legitimate site to encourage users without distrust to provide personal information," explains Omololu. "If a website looks clumsy and non -professional, pause and reveals its legitimate before providing sensitive information."

Even quick search on Google can help you check any retailer with a suspicious website. And if you find negative opinions for this retailer on a site like Fiduciary - Or I can't find much information about them - then it is better to avoid doing business with them.

"Enter only information from your credit card on websites that have a solid reputation," adds Gallstyan.

Best Life offers the most recent financial information of the best experts and the latest news and research, but our content is not supposed to replace professional advice. Regarding the money you spend, save or invest, always consult your financial advisor directly.

The most understanding zodiac sign, according to astrologers