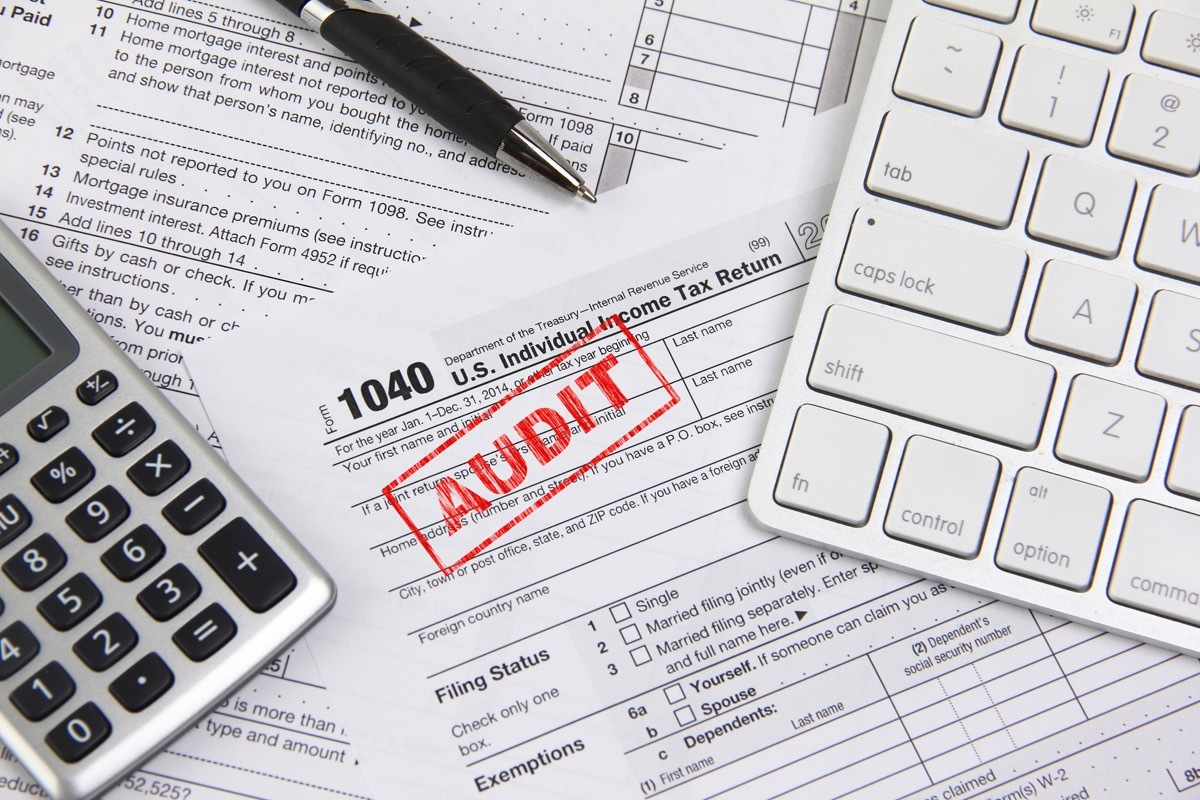

The IRS warns taxpayers of "deeply disturbing" credits that could make them audit

The agency increases the application measures surrounding this sly program.

Fiscal season Maybe one of the most stressful periods of the year. With complex laws and constantly evolving codes, the filing of a declaration remains a confusing process year after year. But the stakes are high to do things well. The Internal Revenue Service (IRS) can choose to Audit any taxpayer And errors found on your income tax return can trigger penalties or even a prison sentence in some cases. Now the agency rings the alarm of a new problem that could make you more likely to be checked. Read the rest to know why the IRS warns against "deeply disturbing" credits.

Read this then: The reason n ° 1 that you could be audited by the IRS, warn the experts .

A new credit program was implemented at the start of the pandemic.

With the adoption of the AID coronavirus law, emergency and economic security (Cares) in 2020, Congress has created a new service program for taxpayers: the Employee retention credit (ERC). The ERC was introduced in order to encourage employers to "keep employees on their payroll despite economic difficulties linked to COVID-19" by making them eligible for new credits.

Employers can claim credits For qualified wages paid in 2020 and the first three quarters of 2021, according to the accounting firm Cherry Bekaert. "The ERC is a refundable payroll tax credit which can reach $ 5,000 per employee in 2020 and up to $ 21,000 per employee in 2021", explains the company on its website.

The IRS rings the alarm on the scams surrounding the ERCs.

In a March 20 Press release , IRS announced that it had added employee retention credit schemes such as "new entry" Dirty Dozen List . Representing the "worst of the worst tax scams", the list is compiled each year and has a variety of current scams that taxpayers may meet, in particular when searching for external aid during the deposit season. AE0FCC31AE342FD3A1346EBB1F342FCB

"For the start of the Dirty Dozen List of Tax Ascams annual, the IRS highlighted employee detention credits following the blatant attempts by promoters to challenge people who are not eligible to claim the credit," said the 'Agency in its new version, adding that it had already published several several people previous alerts on this problem.

According to the IRS, the crooks promote ERC diagrams by "exploding radio advertisements and on the Internet touting reimbursements" from these credits. "These promotions can be based on inaccurate information related to eligibility and calculation of credit," warned the agency.

In relation: For more information, register for our daily newsletter .

The IRS commissioner said it was "deeply disturbing".

Many of those who have really eligible for the ERC have already claimed and received their credits, according to the IRS. Despite this, some promoters are still pushing widespread advertisements that probably target taxpayers who are not really eligible.

"The aggressive marketing of these credits is deeply disturbing and a major concern for the IRS", commissioner at the IRS Danny Werfel said in a press release.

Werfel added: "Although the credit has provided a financial rescue buoy to millions of companies, there are deceptive promoters for people and businesses thinking that they can claim these credits. There are very specific directives Around these credits in the pandemic era; they are not available for simply anyone. "

According to the IRS, third -party promoters who push the ERC often fail to explain the eligibility conditions for this credit with precision.

"They can assert large arguments suggesting that all employers are eligible without assessing the individual circumstances of an employer," said the agency. "For example, only recovery starting companies are eligible for the ERC in the fourth quarter of 2021, but these third -party promoters fail to explain this limitation. This has been reported as the pay fees in obtaining the Presentation of the payroll protection program. "

You can be checked for claiming these credits.

The IRS stressed the importance that taxpayers are aware that the ERC is not available for non-employees. But even employers "must think twice before submitting a complaint for these credits," said Werfel, noting that "companies should be wary of the plans announced and direct requests promising tax savings that are too good to be true ".

Taxpayers are solely responsible for one of the information reported on their own income statements at the end of the day. And the IRS increases the implementation measures of the law surrounding the ERCs on yields, according to the new press release.

"People have to remember that IRS actively audit and conducted criminal investigations related to these false claims," warned Werfel. "We urge honest taxpayers not to be taken in these regimes."

The IRS said that its division of small self -employed companies had formed listeners to examine these types of complaints, and that the agency's criminal surveys division is on high alert for promoters making fraudulent allegations concerning ERC . If you have knowingly filed for false or fraudulent tax forms to request this credit, you may be struck by "serious civil and criminal penalties", said IRS.

But even being the victim of the ERC program of a crook could have serious consequences. "Incorrect IT of this credit could lead taxpayers to repay the credit as well as potential penalties and interest," warned Werfel.

Best Life offers the most recent financial information of the best experts and the latest news and research, but our content is not supposed to replace professional advice. Regarding the money you spend, save or invest, always consult your financial advisor directly.

10 incredibly cool castles from all over the world