50 things that one in 50 should lose their money on

Come on. Currently, you should know better.

With age comes wisdom - usually. After a life of expenses, the lens on what is worth buying and what does not focus in a crystalline scope of 20/20 vision. (Direct flights, brand snacks Name and sheets with high wire numbers: totally worth it. Budgetary alternatives: good ...)

And yet, all the purchase taking is not so cut and dried. Even in the middle age, it is possible to continue to waste money, thanks to the surreptite sales practices of retailers (and, in many cases, your own laziness). Of course, it's only a few dollars here or there, but all that addsquick. So, without any other teen, here are 50 things you would be wise not to spend another penny.

1 Simple home repairs

As you are 50 years old, you need to know how to change a handful handle or damaged threshold. There is no need to divert an extra dough on a handyman's man to do it for you. Always, with that in mind, do not betoo muchConfident about your DIY skills. Know when a project exceeds your skill level. Otherwise, you may cause injury or aggravate the permanent damage of your home.

2 Coffee Fantasy

Let's make mathematics. An Expresso beverage nearby near Starbucks is about four dollars. Do it twice a day, from Monday to Friday and you drop $ 40 athe weekon the coffee. At this rate, you may have enough money saved for a high quality espresso machine than a full-fledged industry in a month or two.

3 The last telephone model

Aim for it: the iPhone X is notthismuch better than the iPhone 8. And yet, it sells almosttwiceThe price ($ 999 to $ 599 respectively). Moreover, if you really want an iPhone x so bad, just look at the Apple prices history and you will know that, in no time, it will be on the market for a fraction of the cost it's today.

4 Ghost electricity

There is a good bet that you constantly drain electricity without even realizing it. As proof, examine the power invoices of our country. All sleeping laptops to overloaded phones (when a phone is 100% of battery life and is always connected) is estimated atCost of US consumers of about $ 19 billion a year. Fortunately, the cup is simple: justTurn off or disconnect the devices that you do not use.

5 Designer supplements

This new intriguing vitamin may have seemed to be healing to everything that has you when you saw it in an instagram ad at 1:00, but make a mistake: you pay an arm and a leg for a little more than your supplement usual that your usual ingredient supplement in a fantasy envelope. The spokespersons for advertising, packaging and celebrity that promote these amazing supplements at all costs, which means that the price will be considerably higher than your multivitamins of pharmacy in the hand-D 'artwork. For supplements, you should really flex, considerThe top 50 supplements on the planet.

6 High-end olive oil

If you cook a lot, you probably burn olive oil tanks on the regular. But unless you are a connoisseur or a leader with a representative to defend, it is not necessary to make fools for the expensive stuff, of grade a, of any right of Italy. For meals, your good bottle OLE of Filippo Berio will do very well. Only the most true of champagne pallets will recover this difference in beer budget.

7 Listeners

As the last smartphone, manufacturers find ways to make earners more and more expensive and unnecessarily complicated. Starting at $ 180 of Apple Ear Pods at $ 300 - More Casphones, you need to know better than blowing money on a product that gives you an experience of marginally best listening to a series of $ 10 buffers that you can choose your corner store. More, youknow You will lose them anyway.

8 Pure pets

Unless you do not die, I'm dead to get into your pet in Westminster, it's silly to invest thousands of dollars in a breeder dog. You could also easily find a small and deserving deserving in a local shelter orAspaper outpost.These animals also need houses.

9 Modem rental

When you register for the first time for an Internet service, the provider provides you with a modem, then allows you to charge you every month for convenience. Often, fees can reach additional $ 10 per month. Consider the fact that you can recover a modem for less than $ 100 these days and that simple mathematics will tell you that in a year you have already passed more than necessary.

10 Dry cleaning

A pair of pants and shirt can end up costing $ 10 - and much more than that in urban environments. Make it a habit and you will see that your expenses quickly worsen - everything for any reason, because most of theThe clothes can be cleaned easily by washing on the delicate cycle or washed by hand at home. The only exception: costumes, dresses, cashmere (and something else marked "dry cleaning only").

11 Paper napkins

While using paper towels here and it is necessary for most people, chances you can reduce at least three quarters of your paper towel by storing a few store towels to clean spills, wiping your kitchen counter and Other basics uses like that. Instead of entering a handful of price paper towels every time something needs to be cleaned, use and reuse these actual towels and discard it in the laundry.

12 Simple car repairs

Of course, you may be less likely to know how to repair a car engine than your father or father. Nevertheless, it is not an excuse to pay the high costs of a mechanic when there are millions of tutorials (start on YouTube) that will teach you to change effortlessly a tire or car battery. Save your money for repairs that require a job.

13 Lottery tickets

1 EN 292,201 338.These are your chances of winning Powerball. And other national lottos do not make much better chances. Entering once in each Powerball - which arrives twice a week - means that you turn a fire at more than $ 200. It's better money, well, anything.

14 Premium gas

While you may want your car as much as possible, if you go out for premium gas, you do a little more than emptying your wallet twice as fast as you would if you have opted for regular. Unless your car specifically requires premium essence, it should simply work well without that, which potentially avoided you a significant amount each time you touch the pump.

15 ATM

Sure, you're telling you,Sometimes my bank simply does not have an automatic window nearby. Have to eat this supplement! But about it, you are mistaken. Nowadays, if you venture to the vice-hazard of America's Behemoth's banks, you can find many offerings that guarantee you no longer pay at ATM. An online bank as an ally, for example, reimburses your expenses at the end of each statement cycle (although they prevail a 1% surcharge on international ATMs).

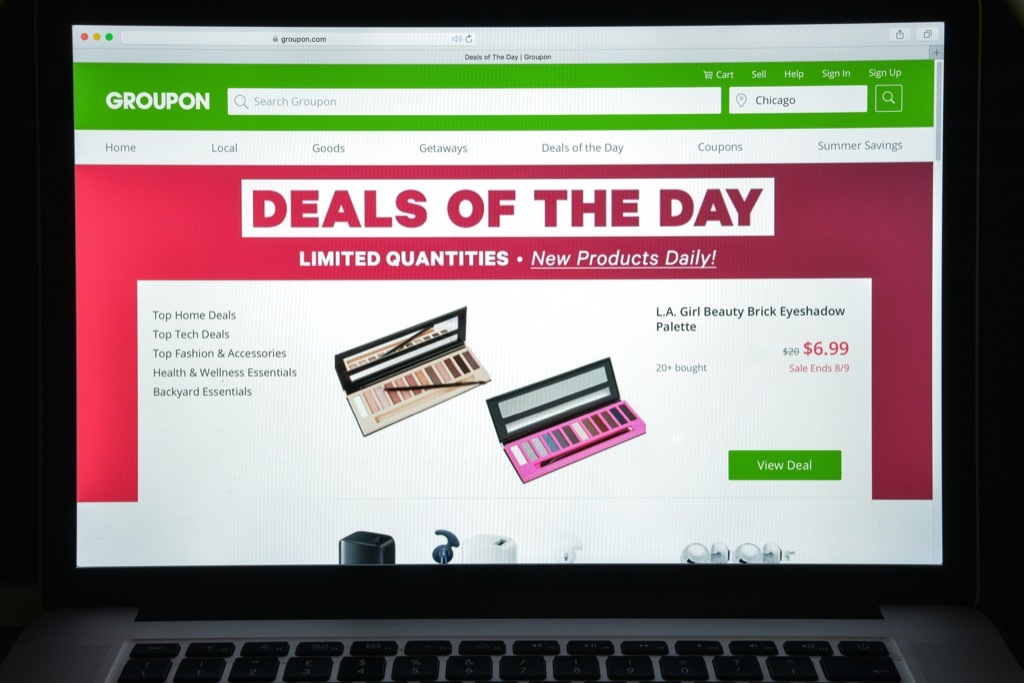

16 Stupid groups

It's amazing how much money can a person can waste while thinking they save money. One of the clearest examples of this: "Groupons" and other "offers" on restaurants, outings and all kinds of things you would not have bought (and certainly do not need).But let's put it like this: pHaving $ 30 in a $ 60 restaurant of good quality food is still $ 30, you could have passed better elsewhere.

17 Full price clothes

Of course, buying beautiful brand brand clothes can be one of the luxuries of life and can be helpful in relation to the attempt to save by buying good quality clothes that will not last as long. But you should know better than crazy about clothes when they have just been released in the store and sell all at full prizes. Retailers constantly put their goods on sale. Just abornerate your time (usually not more than three months) and you will be rewarded with end-of-season points.

18 Late fee

With automatic remuneration and similar services, you have little excuse these days for failing to pay your credit card bills in time, causing the important fines that these companies like to hit you.

19 Interest of the credit card

You must also spend in your means enough for you to be struck with interest charges to pay only the minimum fees. If you find that you can only pay a small part of your cards every month, it may be time to make a serious assessment of your expenses.

20 Extended guarantees

Spend the money on a guarantee for a major purchase could first look a very responsible idea - after all, if something is wrong with the device you just buy, do not you feel smart to have Just spent a small amount of money before you save to buy a brand new? But in fact, the chances you really use this warranty are lightweight and most guarantees do not even cover the majority of the problems you risk meeting.

21 Rental car insurance

Car rental companies love to convince you that you are a bending mudguard away from bankruptcy and your only protection is to buy their insurance overpriced. As prolonged guarantees, it is very unlikely that you will never need to use this insurance and even if you have done, these sneaky policies would be unlikely to cover. Often your credit card company offers stronger protections and has more incentive to cover your fees, allowing you to decline the rental company offer. And if you hit the road in a loaner in the near future, be sure to avoidThe 20 rental worst cars of the last 20 years classified.

22 New car

This is perhaps one of the biggest money burners out there, with a new car estimated to lose about 11 percent of its value as you drive out of the lot, leaving you with a non-negligible monthly payment for the coming years. A wiser movement is to get a used car in good condition and pay it as fast as possible.

23 Parking tickets

Nobody intentionally receives parking tickets, but if you are responsible enough and aware of your environment, you should be able to avoid being struck with them. That means setting your alarm to make sure you wake up in time to move the car or take an extra trick around the block to find a place where you can park more than one window of one hour, you Should know that it is worth putting in the extra effort to avoid the $ 45 bill.

24 Bottled water

Stay hydrated is a good thing, but bottled water is not the answer. Not only the price of it adds (especially if you are on your splurging, like Dwayne "the rock" Johnson)But he is bad for the environment, too. Each disposable bottle adds to the long-time garbage problem of our planet. Get an elegant rechargeable bottle and keep it in your bag, save yourself a few dollars a dayand helping nature at the same time.

25 Eat outside

A good meal in a fancy restaurant can be one of the great pleasures of life and a good way to celebrate a special opportunity or just the fact that it is on weekends. But when you are used to hitting restaurants, spending money on the meal, drinks, and a good start of two to three nights a week, your credit card bill will start looking enough.

26 purchase lunch

Another easy way to lose hundreds of dollars a month is buying your lunch at the office every day. Having a good idea to make your lunch the day before or prepare a lot of something delicious that you can use for your lunch on the week. Then you can spend your lunch break wander, meet a friend for coffee, or another more rewarding activity than pick up your office salad every day.

27 3D movies

The films are already ridiculously expensive (especially when throwing in service charges for online order), so why would you add another 10 5-to- $ $ per ticket for you to have to wear glasses while you look at the movie. Once you have seen a 3-D movie, you realize that it adds practically nothing to the value of entertainment or experience and, if anything, is a distraction. Save money for something better.

28 PRICEY Member Gym

Instead of paying a hundred dollars or more per month to use an elliptical machine once or twice a week, get used to going to jog in the neighborhood. If this is impossible or the weather conditions are too unpleasant, then at least calling your gym and ask them to lower the price or go elsewhere for a better deal.

29 Unused subscriptions

Whether it's magazines, SaaS services, or video streaming subscriptions, you should have learned now to cut the subscriptions that you do not really use. You must set calendar reminders to know when automatic renewals arrive and cancel as soon as you know more than you will not really need these subscriptions or services, or at least for a while.

30 Fancy cleaning products

While a walk in the grocery welcome offer you make you believe that you need a special cleaning product for all different surfaces in your home, the fact is that the soap of Base or bleach and water is usually all you need to get your place in impeccable search. And skip the dear Swiffer wipes and other products that make this a damp cloth can accomplish a fraction of the price.

31 Pre-tanned food

While pretranched cheeses and meats could make it easier to concoct a sandwich, it often costs it up to twice the same thing will cost you when you have to cut you. You should know better now that it's a waste of money and take the two seconds to make your own division is worth it.

32 Extra telephone chargers and cables

Whether it's the replacement of the phone chargers you have forgotten during a trip or have to take a new power cord for a laptop to cover the one you have forgotten at home, you should have learned to Keeping a trace of these products and you will avoid having to pay the often exorbitant fees charged by airport shops and pharmacies to replace them.

33 Grocery store ... when you're hungry

Since you've been old enough to buy your own grocery store, you said not to hungry grocery store, and who remains wisdom as true as ever. You have probably made the mistake several times and finished with a refrigerator filled with food that you do not really need that you would not have bought you had not starving.And for other ways to reduce your invoice Whole Foods, see15 grocery errors that kill your portfolio.

34 Fancy products for laundry

Speaking of linen, another thing you need to know now is a waste of money is all fancy laundry products that television ads convince you will improve your clothes and make it cleaner and more comfortable. Softener and dear detergent causes the less impact on your clothes (if applicable). If you opt for a detergent, basic generic brand just, it is frankly unlikely that you will be able to notice a difference.

35 Order delivery

There are a few nights where you do not have time or energy to concoct a meal and take away is the only logical choice. Although this is good now and then, you can save yourself a little money by avoiding having the meal delivered and instead of picking either up on the way back to work or to make the short trip to the restaurant You to get it.

36 FAD DIETS

Special pills, powders or meal plans that promise you to lose weight or transform your health are not only Baloney 99 percent of the time, they are often an extremely expensive weekly drain on your bank account. You should know it now, whether by personal experience or seeing others go through a few yo-yo regimes themselves, that these manias are a waste of time and money.

37 CHECK CABLE PACKAGE

There is no way you need more than 100 channels, so why are you paying for all? Instead of blowing $ 40 or more per month on a huge list of channels that you rarely look in fact, you should have embellished that you can get a better deal by paying for a streaming service like Netflix or Hulu and may Being a limited package for live sports events if it's a must-have.

38 Roaming costs

If you are a frequent traveler, you should have learned now how to avoid being struck with international roaming costs on your phone, whether ensuring roaming is off before the foot in a foreign country, or d 'Get a phone plan that ensures such use will not cost you.

39 Bank charges

If you have noticed mysterious fresh on your last bank statement, for "service charges" or something of the same wave and that you do not believe that you are actually use, you need to know now that you can call your bank and In almost any case, they will be deleted. But if you do not ask, or do not take the time to review your account transactions, you will continue to lose money in this useless way.

40 Brand names brand

Although generic drugs can not have the names-brands of costly advertising campaigns do, it does not mean they are no less good. Generic contain the same active ingredient as their brand counterparts, as well as some of the same inactive, unless you have a specific allergy to the formulation of a generic prescription, you should be able to use them safely if your Signs doctor off on her.

41 Exercise equipment

While you can save money judiciously by reducing your gym subscription by setting up a home gym in your basement, you can sacrifice all these savings by blowing your money on fantasy, the equipment of Brand new exercise that you use several times and then ignore. A basic exercise bike press or a bench will give you everything you really need, and is usually for a low price on Craigslist. And if you are really looking for amazing training space in your home, start with theseAffordable ways to transform your home into a gym luxury.

42 Cinema snacks

A great place to explode $ 20 on something that would cost $ 5 elsewhere else is the movie cinema concession stand. Popcorn Mediocre and a giant fountain drink could add some more to your pleasure to look at the movie, but hardly justify expenses. You must know that you'd better bring a small snack to theater and keep $ 20 in your wallet.

43 Bread machines and pasta manufacturers

These are a serious cash flow, like other similar and rarely used cooking appliances. While you might think that you will get a lot of a juicer or deep fryer, it is very likely that you use these types of machines a few times before moving on the back of a shelf and To forget quickly about them.

44 Bad boo

If you think these puffs of cheese that you bought from whole foods are better for you than those you have got from your local bodega, you make fun of yourself. Although they can be full of organic ingredients, non-GMOs, at the end of the day, they add empty calories to your daily total - a bit like their less expensive counterparts.

45 Costly baby clothes

When you hear that a friend, a family member or colleague to have a baby, a person's first impulse is often moving to their nearest baby store and buy a show outfit . And while the thought is undeniably well intentioned, do not deceive yourself: even the most adorable babies regularly expel body fluids on their expensive outfits, which means that these designer clothes you have purchased, you will end up Being little more than a burp cloth.

46 In-app purchases

Tempt, even if it may be to buy this enhanced outfit for your character or your advance at a new purchase level than in your favorite game, doing a serious waste. Although the cost may seem small first, only one integrated purchase of $ 3.99 a day for one year will run $ 1,456.35 if you keep used to everyday life.

47 Purchasing Couponing

As a counter-intuitive that it may seem, the couponing can cost you great in the long run. While people who treat couponing as a full-time job can be able to mark impressive cups for little or money, for many people, it means buying huge amounts of things they do not have Really needed - hundred polishing bottles of furniture here, 40 brownie boxes mix there - just to mark a reduction. The final result? A fire sale on this profusion of products when it starts encroaching on the space once designated for the things you really needed to get.

48 Items not delayed

It arrives at everyone: you order something online, it is not suitable or not quite the way you have imagined it, and you pushed it into a wardrobe, making sure you Return soon. Instead, he languished there, gathering the dust, until he becomes the last piece of undesirable ephemera thrown into the stack at the white elephant office.

49 Heating and cooling costs

The heating and cooling costs tend to be two of the greatest monthly bills in a person's life and, unlike a mortgage or a car payment, they never disappear. Unfortunately, it is likely that your own preferences are closely linked to these ever-increasing invoices: habits such as exiting air conditioning when you go out, fixing it to the coldest possible temperature, or launching the heat instead of Put a sweater to another. Your high heating and cooling costs. The good news? A smart thermostat can help you save serious money in the long run, as well as reduce your carbon footprint.

50 Fast mode

This is called Fast Fashion for a reason: these cheap items that you recover in some retailers of your local shopping center are not exactly intended to be transmitted as legacies. While fast fashion stores can have inexpensive but quality bases to complete your wardrobe with, like t-shirts and accessories, if you look at them for wardrobes, you will end up spending more than long-term money when these items wear out inevitably.

Can you guess your state based on this famous statue?