The 10 best budgeting applications to increase your savings

You have a powerful personal money manager in your pocket.

While we start a new year, a resolution at the top of countless lists of people is kept to "spend less, save more". But as for many resolutions, even the best intentions will not increase a lot if you do not combine it with a serious stage step by step of how you will accomplish.

Fortunately, it's easier and it's even fun as ever getting a handle on backup and expenses with the wide range of available budgeting applications. These tools allow you to track your expenses and see where your money takes place, often in real time and easily accessible from your phone. And for more ways to get your finances in excellent working order, know them52 ways to be smarter with money in 2018.

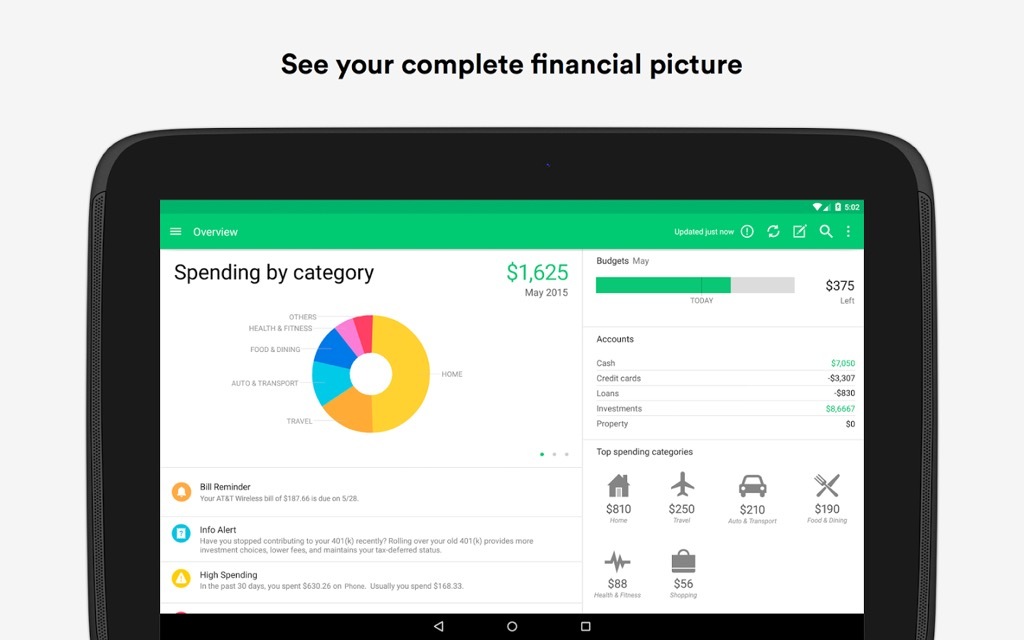

1 mint

One of the most popular budgeting applications, probably because it's also one of the easiest to use,mint Connecting accounts of your bank, your credit card and your investment accounts, giving you a complete vision of your savings, your expenses and your assets.

It pushes the numbers and provides you with your average expenses by each category (self and transport, invoices and public services, etc.), and makes automatic suggestions for budget objectives according to these expenses and income. It allows you to plan a single expense only only recurring monthly expenses and all done in a fairly cool interface that makes it almost fun to reduce your expenses. And for more ways to be soap with money, here is here40 ways to save 40% of your paycheck.

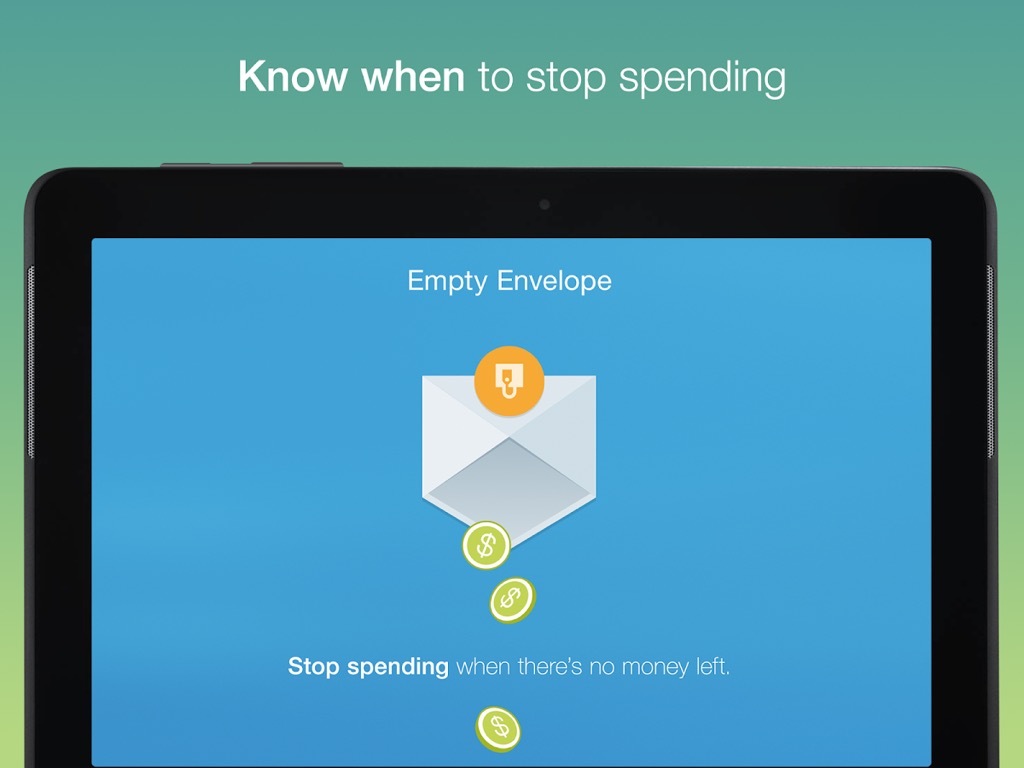

2 GoodBudget

Formerly called EEBA, or easy envelope budget,this application Always use the "Envelope" approach of expenses and economies that has been effective because people used paper envelopes to put aside cash for various expenses each month. You decide how much you will spend in each category for the month, then "pass from the envelope" rather than your credit card or savings account.

The application facilitates the creation of a budget that reflects your objectives and values, putting aside what you think you need to be necessary every month and also synchronize it with your spouse, your family or any other person with whom you have to coordinate your expenses. And for more first-rate tips, here is here20 side jostles to put your savings on steroids.

3 Mowl

Talk about the envelope system,this application Take a similar approach to combining the secular envelope system with new practical technology. It offers several different levels of plans, each cost a little over a month. These vary from Mvelop Basic, which includes real-time budgeting and integration with bank accounts, credit card and financial accounts, up to Mveelles complete, which offers a personal financial trainer to help you reduce Your expenses and "wag your finances," help them define objectives and monitor progress with the encouragement of another person. And for more advice, try them40 ways to seriously stimulate your savings after 40.

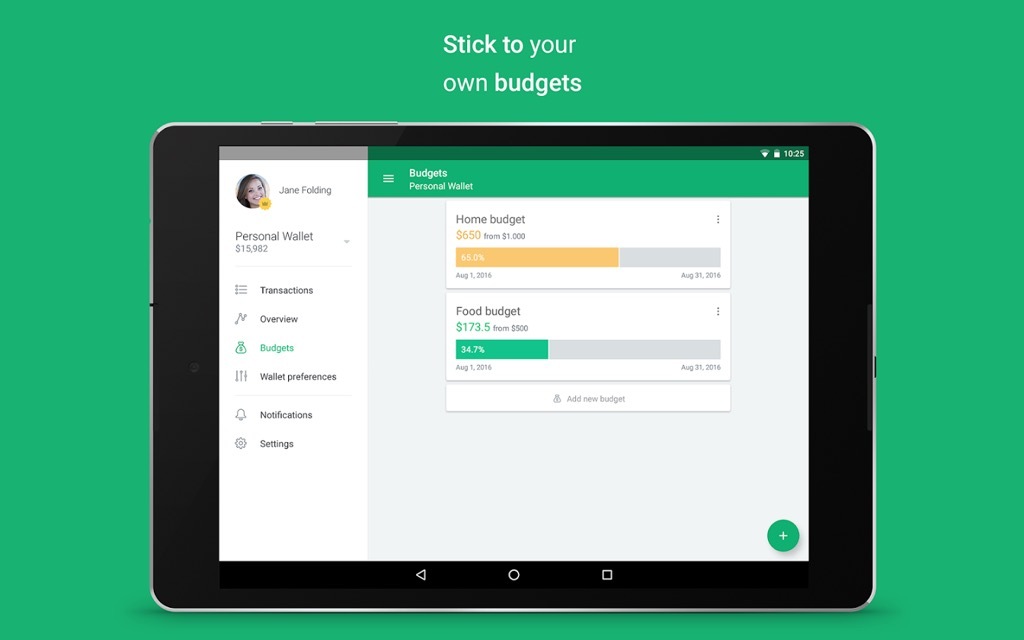

4 Spender

Self-proclaimed the "most intuitive finance of all time" application "This tool Provides unobstructed views of where your money goes every day, week and month. It allows shared manual portfolios so that you and your family or friends can take special expense and savings areas, and includes a "mode of travel" that can support any other international currency if you are traveling or working abroad. . It is free to use, but also offers the premium spent, allowing users to create as many wallets as possible, synchronizes with bank accounts and more.

5 Wally

This tool "intuitive money management"Helps users compare revenue to expenses, giving a clearer idea of where their money goes every month. It allows you to connect your expenses with manual entries as well as to photograph a receipt, and even uses location services to determine where you are when you enter an expense that allows you to enter this detail. It is also useful in its notifications, allowing you to know when a bill is due for payment or when you reach a savings target.

6 Protective

This application Connects to all your financial accounts and creates a simple and immediate budget, offering ways to reduce your expenses - that you will actually follow. It is good to give you a big picture of your finances, but also allowing to drill in individual bills and expenses, to find ways to reduce recurring invoices and reduce expenditures in some of your indicative categories.

Pocketguard generates easy diagrams to prepare for your expenses and make it easy to see where you could allow you to make fittings.

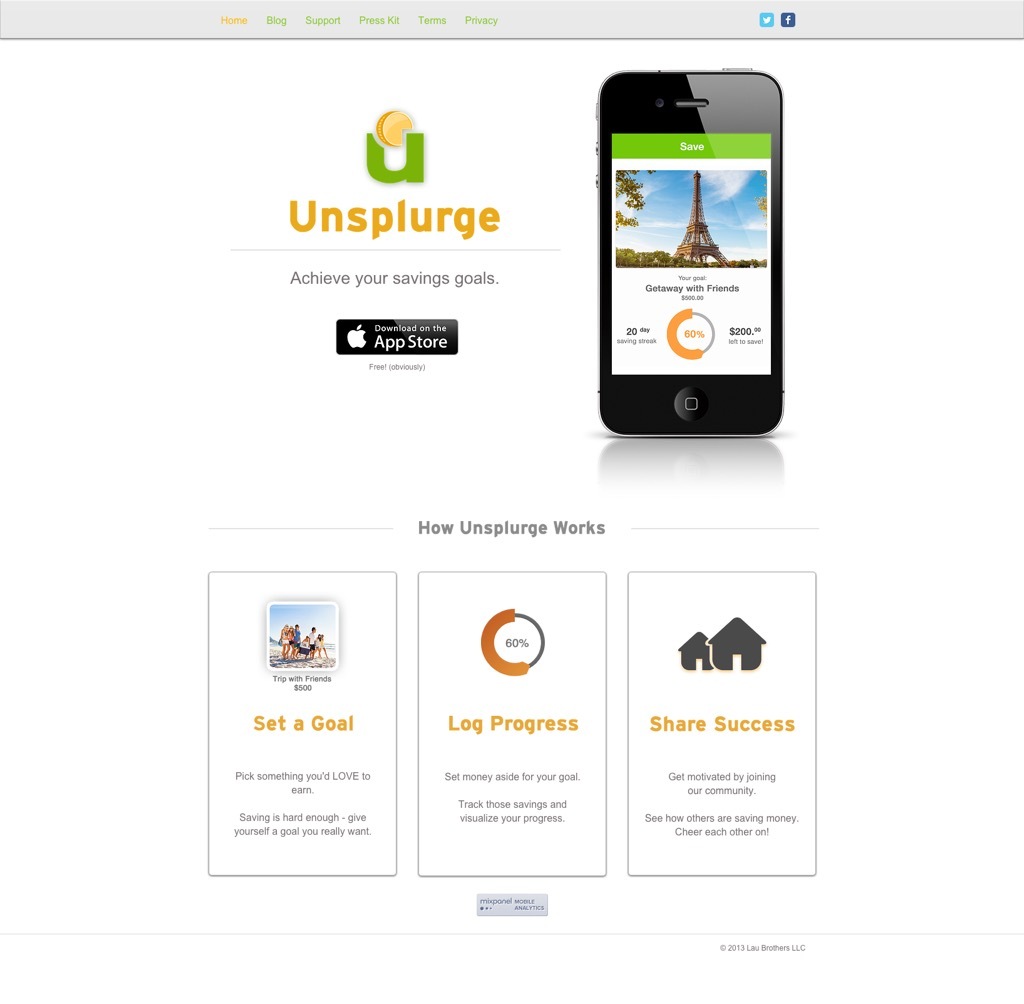

7 Denigrate

This applicationis less interested in creating a complete vision of your expenses and your income than to help you with a goal: save for a single purchase. You can choose whatever your long-term goal, your holiday car, a new car, repay a student loan - and then connect and follow your progress in setting up the money to pay for that. It also includes a social component, where you can see what other people saves, how they progress to that and encourage them as they go. And if you are looking for a holiday inspiration, do not miss the20 most zen locations on the earth.

8 You need a budget

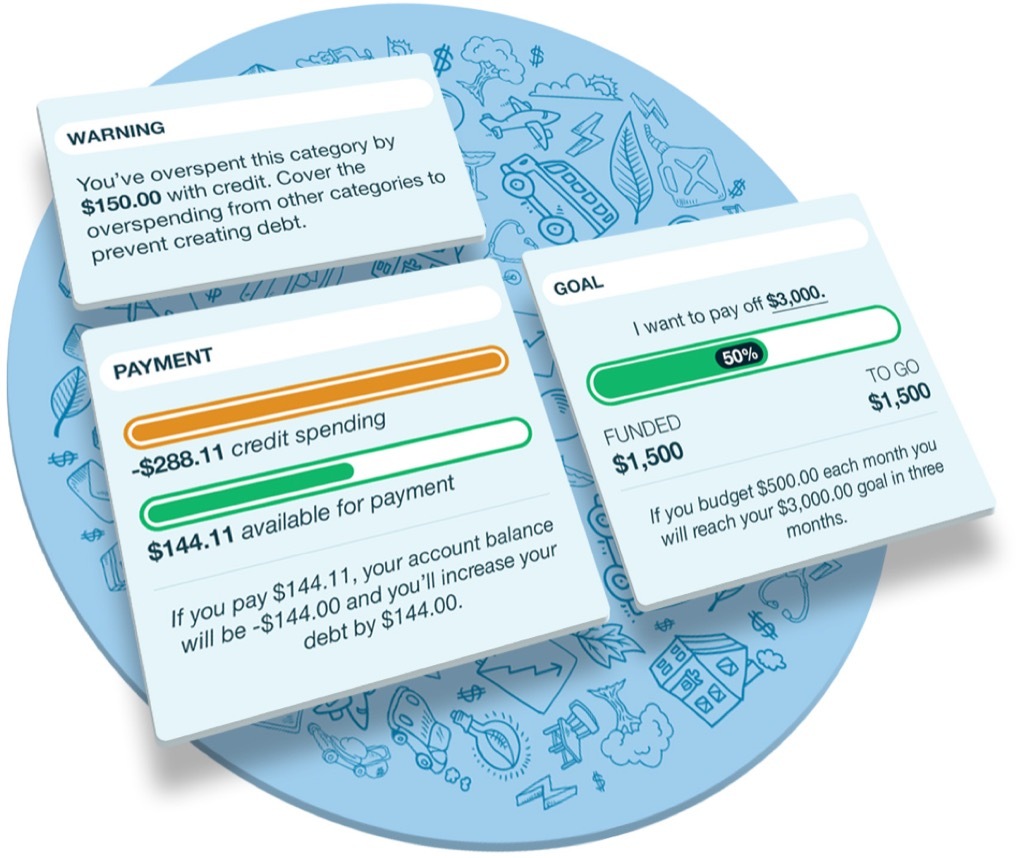

This application Combines tracking income and expenses with self-help rules on your expenses. For example, one of its strict strices is to "give every dollar work", to be intentional of what you want your money foa before spending it (ie that the allocation of A specific amount in dollars in each category of expenses), rather than let your fraternal income over the weeks. It urges you to "kiss your real expenses", not only to pay for recurrent and daily expenses, but to be honest about what big items in the ticket in the road (holidays, holidays, a new car) and create budgets for these. You need a budget allows you to do this simple and adjust your budget as needed, and also offers online courses to users to join in order to fully get their expenses under control.

9 Budget

This application Exercise more deeply than most others, providing a daily follow-up of your expenses, telling you how much you can allow you to go now, rather than during the month as a whole. It also allows you to create your individual monthly budget, including recurrent and ad hoc expenses and revenues, with savings targets and views of your expenses by individual category, allowing you to see where your money goes daily or weekly. You can also use the application to export monthly data to a CSV file, allowing you to work with Excel or elsewhere.

10 Homebudget

This expense tracker Gives you an immediate summary of your expenses, your invoices, your income and your budgets for the current month, allowing you to add, modify and delete easily if necessary. You can generate reports to see a trend graph of your expenses and income in previous months, exporting data by email to your computer. It also includes a forecast feature that you can use to predict the activity in each account. You can easily synchronize it on your devices and share with family members. Take this new focus on your finances and channerate using the40 Best Ways to Restart Your Career So you can earn more money, period.

To discover more incredible secrets about the life of your best life,Click hereTo register for our free daily newsletter!

Do not have that work advantage makes you more likely to get Covid