6 subtle signs that you are the victim of banking fraud, according to experts

The crooks become more sophisticated, warns the FTC.

With increased fraud, Protect your finances is more important than ever. In fact, the Federal Trade Commission (FTC) reports that consumers lost more than $ 3.3 billion Fraud in 2020, marking a spectacular increase of $ 1.8 billion in fraud losses in 2019. Banking fraud can be particularly pernicious because it does not necessarily force you to fall for a scam.

If you notice one of the signs of banking fraud, it is important to take immediate measures, advises Sarah Martinez , a private investigator, expert in financial fraud and founder of Privacon surveys .

"Contact your financial institution to report suspicious activity and freeze your accounts until things are resolved," she recommends. "In addition, you can also report the incident to the police and your credit report agency. Regularly examine your financial statements. And frequently check your credit report."

Wondering which red flags are looking for? These are the six subtle signs that you are the victim of banking fraud, according to experts.

In relation: The woman loses $ 33,000 at the bank scam - here are the red flags she missed .

1 You notice unrecognized bank transactions.

Stephen R. Hasner , Managing partner of the law firm based in Georgia Hasner Law PC , says that one of the most common signs of bank fraud is to see unusual costs on your financial statements. Fraudulent medical expenses are a particularly common problem because everyone has medical invoices and few people closely monitor their insurance plans.

"You would be surprised to see how well this tactic works well. People do not remember the pharmacy where they bought their prescriptions or the health center they have visited, so that they cannot check (or push back) on the charges they see on their declaration, "he notes.

Martinez says that there are simple ways to help prevent this type of problem. "Use online banking notifications to remain informed about any unusual transaction," she said Better life . "Regularly check your bank and credit card readings and be careful of small insignificant accusations - a fraudster can sometimes test an account before trying greater transactions," she warns.

2 We refuse you access to the account.

If you connect to your bank accounts and find that you are locked or your password has changed, it is a probable sign that someone is trying to commit bank fraud.

"Several unauthorized connection attempts or changes to your account information may indicate that someone is trying to obtain unauthorized access," explains Martinez.

To avoid this, use unique passwords, be sure to modify them with a certain frequency and activate two-factor authentication for added password protection. Never share your personal information with anyone and inform your bank immediately if you think your account may have been compromised.

In relation: If you receive a telephone call from one of these 12 numbers, it is a scam .

3 You lack mail or bank statements.

Martinez says that another red flag that you may be the victim of bank fraud is that you have noticed a sudden change in the way your statements are delivered to you - or they have stopped presenting themselves completely. AE0FCC31AE342FD3A1346EBB1F342FCB

"If you generally receive statements by post and they suddenly stop, it may be a sign that a fraudster has changed your contact details to access your account and hide his identity," notes Martinez.

4 You have reduced a legitimate transaction.

Then, if your legitimate transactions are reduced, this may be due to a past fraudulent activity, says Martinez. Instead of simply switching to another form of payment, it is important to call your bank to reach the root of the problem.

"Communication is essential," said Ashley , CPA, a senior tax shareholder and an expert contributor to Dividend . "The reporting of the suspicious activity at your bank immediately gives them the best chance of investigating, stopping potential losses and keeping your accounts safe in the future. In many cases, people are not responsible If they are reported quickly. "

In relation: Banks suddenly close accounts at the national level - here is how to protect your funds .

5 You receive unexpected replacement cards.

If you receive a replacement credit card by post, you should never assume that this is a normal protocol for your bank.

"If new credit or debit cards are starting to arrive by post, it could be a sign that someone has tried to modify your account information," explains Martinez.

"Being vigilant but balanced is the best way to avoid the stress of fraud - know the signs so that you can act, but also remember that banks want to help if problems arise," adds Akin. "With a few simple precautions, everyone can feel more safe with their financial accounts."

6 You have received suspect texts from your bank.

Finally, according to a new 2023 analysis of the FTC, False bank fraud warnings Were the most common form of scams by SMS reported to the agency in 2023. In fact, "imitating text reports have increased by almost twenty times since 2019", writes the FTC.

In this phishing scam, fraudsters pretending to represent the bank asking people to check the transfers or the important purchases they have not made. After having created a feeling of urgency, the victim of fraud is linked to a false representative of customer service, which collects his private information and uses them for fraudulent purposes.

If you receive a text like this, rather than logging in via a phone number they provide, make sure to call your bank's main customer service line. They will check if the warning in the text is fraudulent, helping you to avoid a financial disaster.

For more financial security advice sent directly to your reception box, Register for our daily newsletter .

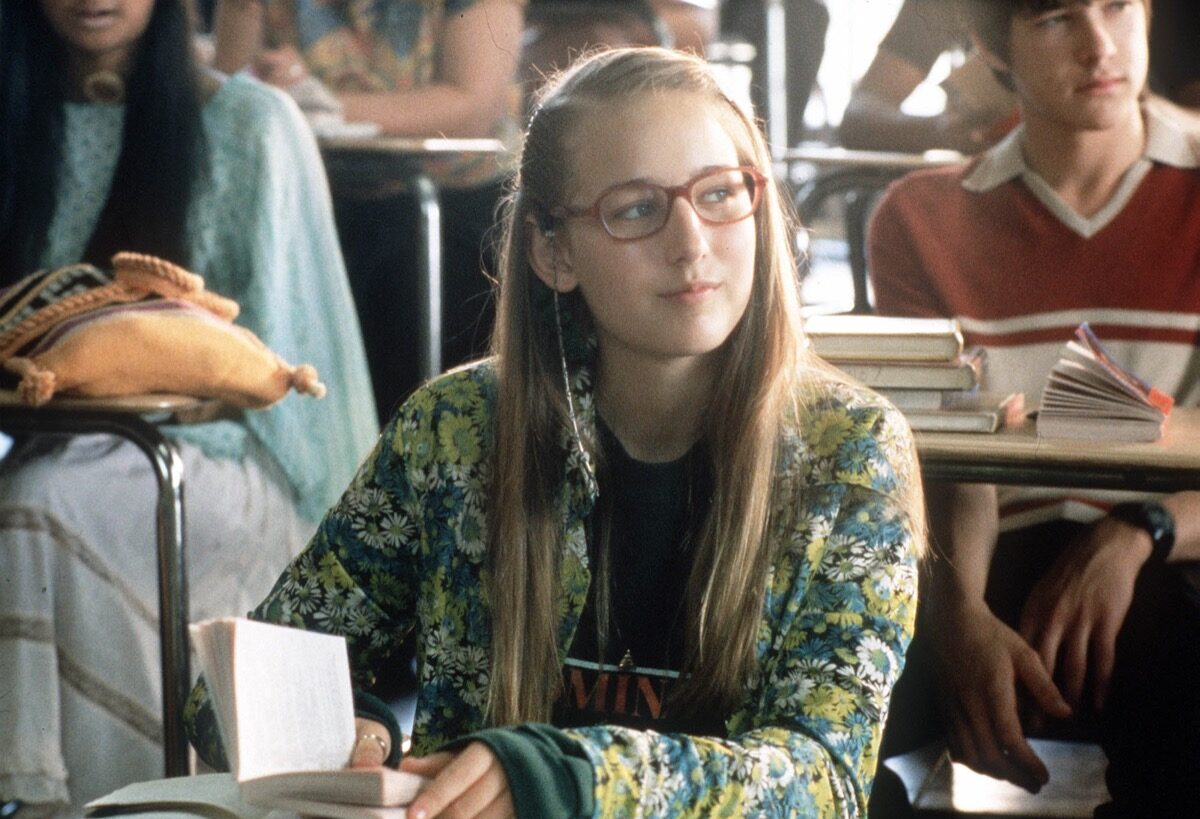

This' 90s teen star leaves Hollywood a decade ago a decade ago. See Leelee Sobieski now.

This is the most popular beer in your state, according to the data