Irs issues a new alert on what you need to do before the end of the year

This can help you avoid a "potential surprise" when you put your taxes in 2024.

The stress of fiscal season Is enough for most of us never want to think about taxes again, which is alone in the same calendar year. But you could hurt yourself on the whole line if you wait until January to start gathering things for the deposit. In fact, the Internal Revenue Service (IRS) now urges taxpayers to ensure that they perform certain tasks by the end of 2023 in order to avoid the potential consequences. Read the rest to discover what the last IRS alert implies.

In relation: The IRS announces important changes in income tax declaration for next year - are you assigned?

The IRS claims that taxpayers should review their tax restraint now.

Dom does not wait for the new year to start thinking about your taxes. In a November 3 Press release , the IRS has issued a new alert on tax deductions. The end of 2023 was coming to an end, the agency urged "taxpayers to review their tax reservoir as soon as possible".

"With only a few weeks of the year, the IRS encouraged people who have not recently verified their restraint to do so soon so that they can make necessary deduction adjustments," said the agency in its communicated.

In relation: The IRS warns that the complaint of these credits can provide you with audit and a fine .

This can help you avoid a "potential surprise" next year.

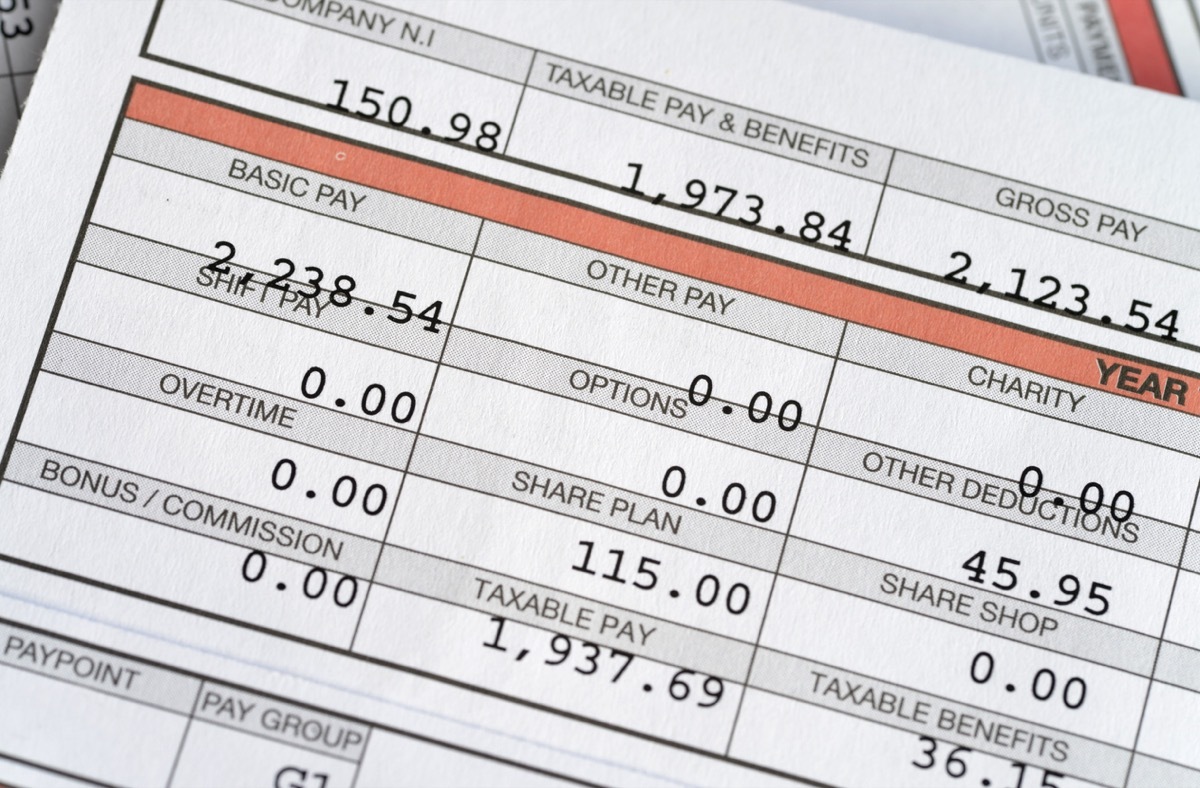

There is almost always a sum of money that comes out of each pay check, which is our tax evasion . This refers to the income tax that our employers hold our salary to pay the IRS in our name throughout the year. But there is no fixed amount that they withdraw for everyone - the restraint of the tax by the tax varies from one person to another.

In fact, the IRS said that around 70% of taxpayers also retain a lot From their pay check - this is why they end up with a refund after having filed their declaration. On the other hand, some taxpayers - in particular those who earn income that are not subject to restraint, such as income from rental properties, concert economy work or independent work - does not hold enough During the year, which led them to pay a big balance during the tax season.

This is why the agency encourages taxpayers to review their tax reservoirs in order to "avoid a potential surprise" when they submit their declaration in 2024. AE0FCC31AE342FD3A1346EBB1F342FCB

"An adjustment made in the last weeks of 2023 could still help to avoid an unexpected result, such as a big reimbursement or a balance due, during the tax deposit next year," the IRS said in its press release.

In relation: 6 secrets of accounting income tax declaration .

You may want to modify your tax reservoir according to certain factors.

According to the IRS, the reservoir of a person's regular tax is generally determined By two things: the amount of the income you earn and the information you give to your employer on your W-4 form. But the agency said that "common and unforeseen events can be a trigger for retention adjustments".

For your taxes in 2023, this could include job loss, natural disasters such as forest fires or hurricanes and life changes such as marriage or childbirth.

"The IRS reminds taxpayers that a refund is not guaranteed," added the agency. "Appropriate restraint adjustments help people stimulate remuneration at home rather than being exaggerated and recovering it in tax reimbursement."

The IRS has an online tool intended to help you.

If you wish to follow the advice of the agency and check your tax reservoir, there is an easy way to do so. The IRS has an online tool called the tax reservoir which can "help taxpayers to determine if they have too much income tax and how to adjust the tax reservoir", according to the press release.

This can also help you see if you need to remember more or make an estimated tax payment to avoid a significant tax bill when you produce your 2023 income declaration.

"The tool offers workers, retirees, self -employed workers and other taxpayers a simple to use and user -friendly way to calculate the correct amount of income tax they should have retained salaries and pension payments Depending on their full set of facts and the circumstances, "the IRS said in its release.

If you use the tax reservoir and decide to change your tax reservoir according to your results, you can do one of the three things. You can fill out a new W-4 form and submit it to your employer, fill out a new W-4P form and submit it to your payer, or make an additional tax payment at IRS before the end of the year, According to the website agency.

In relation: For more information, register for our daily newsletter .

Best Life offers the most recent financial information of high -level experts and latest news and research, but our content is not supposed to replace professional advice. Regarding the money you spend, save or invest, always consult your financial advisor directly.

33 crazy fact that you have never known about the Kardashians