4 warnings on the use of turbotax, according to experts

Here is what you need to know before using this popular software to deposit with IRS.

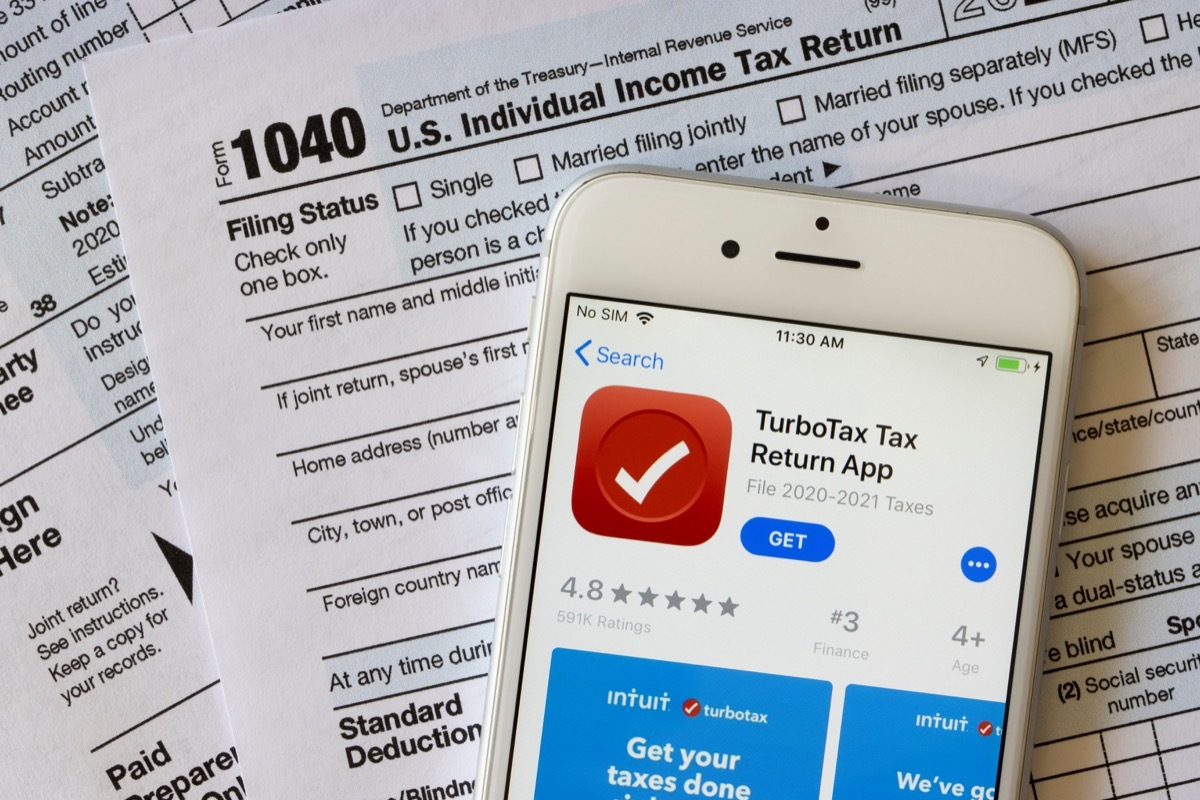

No matter how simple your financial situation can be, most people will always need a little help when depositing with the IRS. And while some can choose to Hire a professional accountant , millions of people turn to software such as Turbotax to help prepare their taxes each year. But even if the popular program can be an excellent adjustment for anyone looking to save money on expensive accounting rates, taxpayers should know a few things before starting to fill the forms. Read the rest for warnings on the use of Turbotax, according to experts.

Read this then: 3 IRS deductions that you cannot take this year, warn the experts .

1 The program can by default data from previous years.

Even if we put our taxes once every 12 months, there are a lot of things that can change during the year. Everything, employment movements and new income flows, marriages and growing families can make your financial situation quite different when you start preparing for your information.

According to experts, this can be particularly problematic for certain taxpayers who count on the convenience of software.

"A major concern about the use of Turbotax is the postponement of calculations for past years", " Jeff Jackson , A accountant And a tax expert with Justanswer, says Better life . "For example, if the taxpayer includes credits and taxes of the previous year of the old income declarations, credits could be applied incorrectly - or not at all."

Unfortunately, this can lead to the loss of reimbursement of taxpayers or not to receive certain deductions. "This could also mean that the taxpayer does not apply limitations or reimbursement of taxable tax," he adds.

2 A new situation could make the deposit process much more difficult.

Many customers are attracted to Turbotax for its speed and relative ease, allowing them to fill in the forms and intimidating papers that make up each classification in a fraction of time. But in addition to missing potential deductions, Jackson also warns that the same convenience can become a headache when the time comes to make changes when using the program.

"The other potential problem with Turbotax reports, cross elements and pre-topped data is that it is extremely difficult to change in many cases," he said. "These preliminary data can enter into the taxpayer's performance as static, and it could take hours to change and resolve via Turbotax customer service."

Unfortunately, this could prepare you for a long and confusing process. "The average individual taxpayer may not even realize that this data is wrong because postpones apply more complicated tax rules than taxable income," he warns.

For more financial advice delivered directly in your reception box, Register for our daily newsletter .

3 You could lack solid advice from a professional.

For some, Turbotax can provide a relatively simple way to properly deposit your taxes with minimal effort. But some experts say that even if it can be useful in many cases, you could sell yourself in the open by not bringing an accountant who can help you get the most out of the process. AE0FCC31AE342FD3A1346EBB1F342FCB

"Depending on your situation, you may want to pay a professional for preparing income and future tax advice in order to prepare you for the future," said Robert Farrington , founder and CEO of The college investor . "Tax software does not provide any type of tax advice. Questions such as if you need to maximize a retirement plan or buy an expensive company now or later, it is better answered by a taxation."

4 You may fail to enter certain crucial data.

While people may not have their say to know if they or not taxes, the style in which they choose to do it can - and often - significantly from one person to another. Some may have their documents and files of the year organized and ready to leave for a quick deposit. Others can adopt a quieter approach that is more based on the motivation of a delay to make them. But in both cases, any person depositing using Turbotax could lack the inclusion of important information due to the functioning of the software.

"Another problem that taxpayers could be confronted with is that they are not invited to enter certain data if they have not said to Turbotax at the very beginning, they have some income," said Jackson. "So, if you get late forms and started your return early, you might not be invited to enter data because you did not indicate at the start that you have a certain type of income."

Jackson says that this can affect taxable items such as playing gains or reimbursement of the state tax, which count as an income. "As you are not asked to add these articles, this could confuse a taxpayer, and they may not end up including this income in their declaration," he warns.

Best Life offers the most up -to -date financial information for the best experts and the latest news and research, but our content is not supposed to replace professional advice. Regarding the money you spend, save or invest, always consult your financial advisor directly.

The most mysterious zodiac sign, according to astrologers