Here's how much you should save 35, say experts

And why advice sent social media into a Tizzy.

aarticle by the MarketWatch journalistAlessandra MalitoBy saying that retirement experts advise to have at least twice your salary saved when you are 35 years old, causing the problem on social media. The millennia in particular are disconcerted as to how anyone can possibly save as much money at half-thirty.

Many social media users complain that this Council applies only to those of extremely high positions.

According toRecent statistics66% of people aged 21 to 32 have absolutely kept for retirement - and, from those who saved, most have less than $ 20,000 in the bank reserved for their dusk.

To be fair, the article admits that the millennials, which now make up the majority of the country's workforce, face unique challenges that may prevent them from these savings objectives.

"Today's 30-year-olds (and over 30 years of age) are in the prey of a committeeing student debt, which has just attained $ 1.31 billion and affects millennia more than any generation who prepared them, "says Malito.

The article did not take into account another reason for the millennial control, which is that many have entered the housing market during an unemployment crisis and a stagnant economy. The 1990s were a great decade for tenants, because barely barering rents and revenues increased by almost 10%. From 2000 to 2010, however,The rent has increased by 12% while the revenues decreased by 7%and the figures have been complaining since. In other words, today's tenants are much more accumulated than baby boomers or Gen Xers.

Although people are aware of the current economic challenges, many experts also argue that the main reason for millennia are not economical, it is simply because retirement is low on their list of priorities. Many are breathing houses for larger and more expensive abuses. Some may choose to split into a large wedding, which costs $ 35,000 in America. And others just prefer to "live in the moment", spend what money they have on traveling and enjoying life now instead of thinking in the future.

In a newBANKRATE.COM Survey, 49% of Americans who have financial regrets do not try to repair them, 19% of the plan to tackle their problems in the coming year, 6% said they will finally have it, and Frankly 25%. said they do not plan to treat their problems at all.

It's aCarpe Diem The mentality that supports many financial experts, which suggests trying to save more money, registering in a 401K employee-sponsored plan or open a Roth IRA (which allows people to withdraw the money they have invested without penalty) to help plan retirement.

Or, you can just follow our sage tips, mastering the40 ways to save 40% of your paycheck and25 rules for a rich retirement.

To discover more incredible secrets about the life of your best life,Click hereTo register for our free daily newsletter!

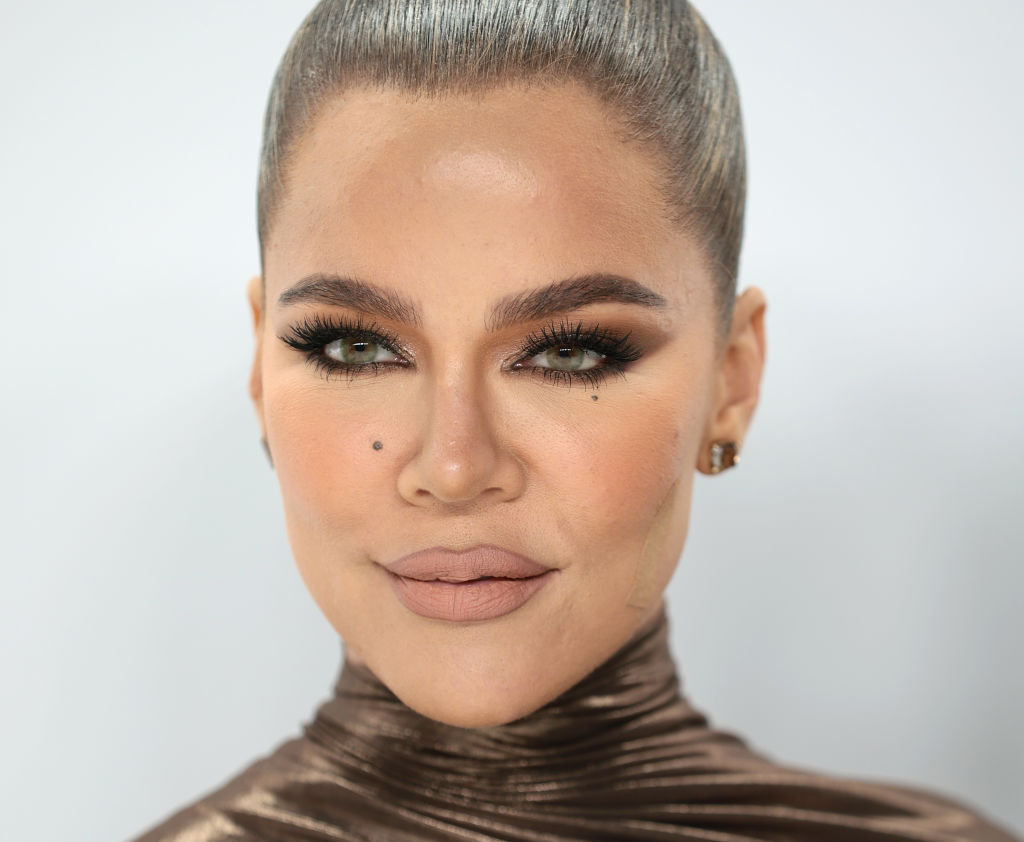

16 outfits from Jennifer Aniston who prove that she always looks good