This credit card will get you the most repayment right now

Experts say it's the best cash credit card currently on the market.

Let's admit that, choose the right credit card can be a stressful process. There are so many variables to consider - annual fees to the credit score requirement - not to mention the various rewards and benefits for each cards offer, as well as how they are aligned with your lifestyle andexpenditure habits. Then there are these hidden fees and interest rates you need to count. In other words, it takes a lot of work to make a truly informed decision when it comes to choosing a credit card that suits you. Maybe a goodSilver recovery program is high on the list of priorities for your credit card because, well, who does not like extra money in his pocket?

To help you decide on the credit card that will get you the most repayment, the experts of the Weatthub personal finance siteCompared More than 1,500 Current Credit Card Offers. From this large swimming pool, they reduced the ground to the cards that offer cash rewards, comparing offers based on initial premiums, reward rates, annual fees and more. From this analysis, here are the best credit cards that you will get the most repayment right now. And for more money, checkThis is the state where your money is worth the least.

8 Visa CashBack combining signature Credit card

Best: Silver recovery on all purchases

Repayment rate: 2.5 percent

Annual: $ 0.00 for the first year; $ 99.00 after that

What kind of credit you need to get a: Excellent

Learn more about theVisa credit card credit card combining cashback here.

If you are afraid of having the remorse of the buyer after choosing a credit card, put it in perspective by checkingWhat you are more likely to regret that everything you do.

7 Discover the

Best: People with bad credit

Repayment rate: 1-2%

Annual: $ 0.00

What kind of credit you need to get a: Bad

Learn more about theDiscover the computer credit card here.

6 Banking money signature card + visa

Best: Cash bonus for a good credit ($ 200.00)

Repayment rate: 1-5 percent

Annual: $ 0.00

What kind of credit you need to get a: Good

Learn more about theU.S. Bank Cash + Visa signature card here.

And to make sure you have money to repay these monthly bills, avoidThe biggest career error you will ever do, according to experts.

5 Chase Freedom Unlimited

Best: No Apr on purchases

Repayment rate: 1.5-5 percent

Annual: $ 0.00

What kind of credit you need to get a: Good

Learn more about theChase freedom Unlimited credit card here.

And for more things that will help you and your family stay on the right track, checkThe n ° 1 sign that you should not buy this house, according to real estate agents.

4 Capital One Credit Card QuickSilverone Cash Rewards

Best: People with rightly title credit and looking for weak annual fees

Repayment rate: 1.5 percent

Annual: $ 39.00

What kind of credit you need to get a: Fair

Learn more aboutCapital One QuickSilverone Cash Rewards Credit Card here.

3 Citti Double Cash Card-18 months bt offer

Best: Lump sum rewards

Repayment rate: 2 percent

Annual: $ 0.00

What kind of credit you need to get a: Excellent

Learn more about Citi Double Payment Cardhere.

2 CAPITAL ONE SAVORY CASH REWARDS Credit Card

Best: Dinner and entertainment

Repayment rate: 1-4 percent

Annual: $ 95.00

What kind of credit you need to get a: Good

Learn more about Capital One Savor Cash Rewards Capital Cardhere.

1 Preferred Cash Blue Cash of American Express

Best: Most of the global cash

Repayment rate: 1-6 percent

Annual: $ 0.00 for the first year; $ 95.00 after that

What kind of credit you need to get a: Good

Learn more aboutPreferred Cash Blue Cash of American Express HERE.

And for more useful information delivered in your inbox,Sign up for our daily newsletter.

The USPS worker warns "you may not receive the mail" while employees come out

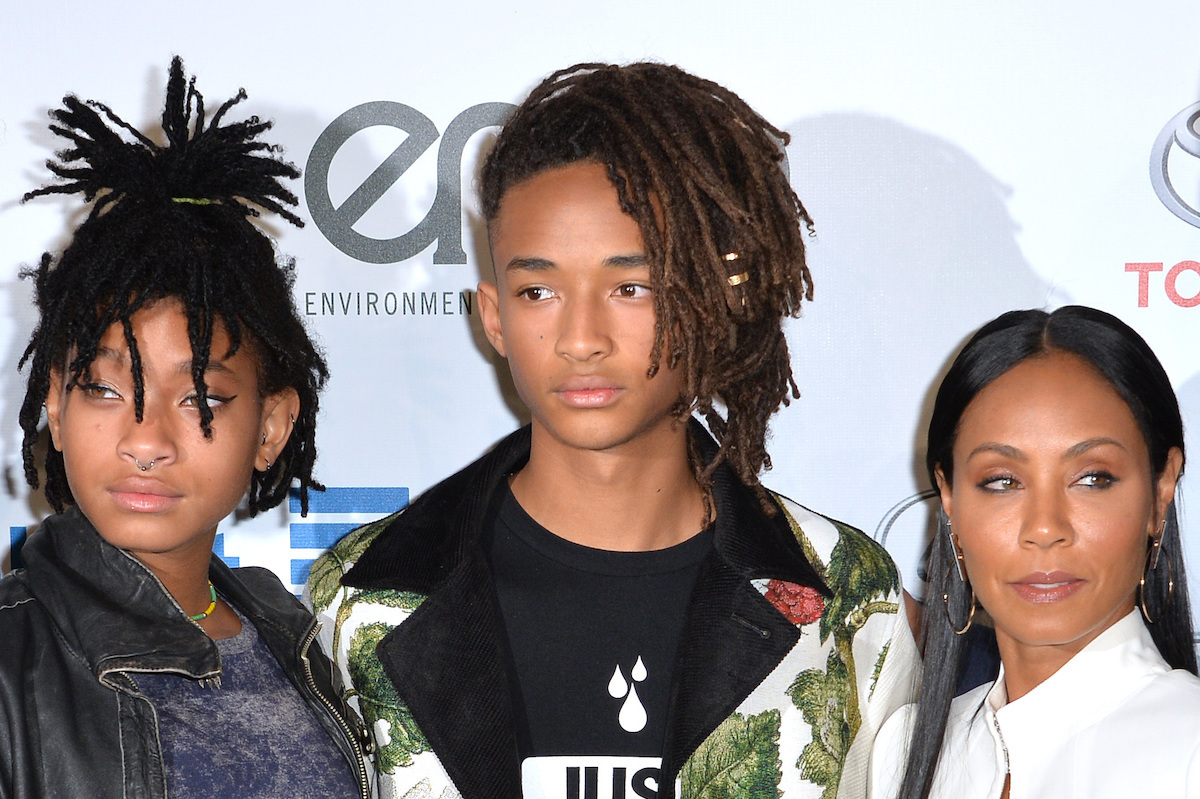

Jada Pinkett Smith said Willow and Jaden inspired his new career loop