What does a credit card skimmer look like? 7 ways to spot a

This guide supported by experts can help you protect your money and personal data.

Don't panic, but criminals love To get your hands on your credit or debit card . This is not exactly news from the latest announcement: your cards are an easy way to spend your money and empty your accounts. To avoid putting our finances in danger, we quickly canceled our cards when we notice them missing, but the crooks have become Savvier over the years, determining how to access your data without ever really pocket your card. One of the most common ways to do this is to use a credit card skimmer. These devices collect and share information from your card with crooks, so it is important to know exactly what you do. But what does a skimmer of the credit card look like and how can you locate one? Read the rest for our guide supported by experts.

In relation: Credit card skimmer found in another Walmart self -diet - how to protect you .

What is a credit card skimmer?

This first step to protect you from a skimmer from the credit card is to know exactly what it is. In simple terms, it is a "sly device designed to steal information from the magnetic strip of your credit or debit card," Dhanvin Sriram ,, Former financial analyst and a cybersecurity expert, says Better life .

The use of these devices dates back at least 2002, when CBS News reported that around 80 people had obtained their stolen information in a singular card skimmer. Until then, people like the California prosecutor Howard sage told the media that they "thought skimmers were an urban myth".

What does a credit card skimmer look like?

Although credit card skimers can vary in design, they generally tend to be "small discreet devices that are attached or to adapt to the location of the payment terminals of payment terminals", according to Josh Amishav , founder and CEO of Data violation monitoring platform Breachsense.

"Certain foams are incredibly sophisticated, perfectly imitating the appearance of the real card reader, which makes them difficult to detect," explains Amishav. "Others are awkwardly adjusted or have slight color discrepancies or additional overlays that help them."

Where are the skimmers of the credit card?

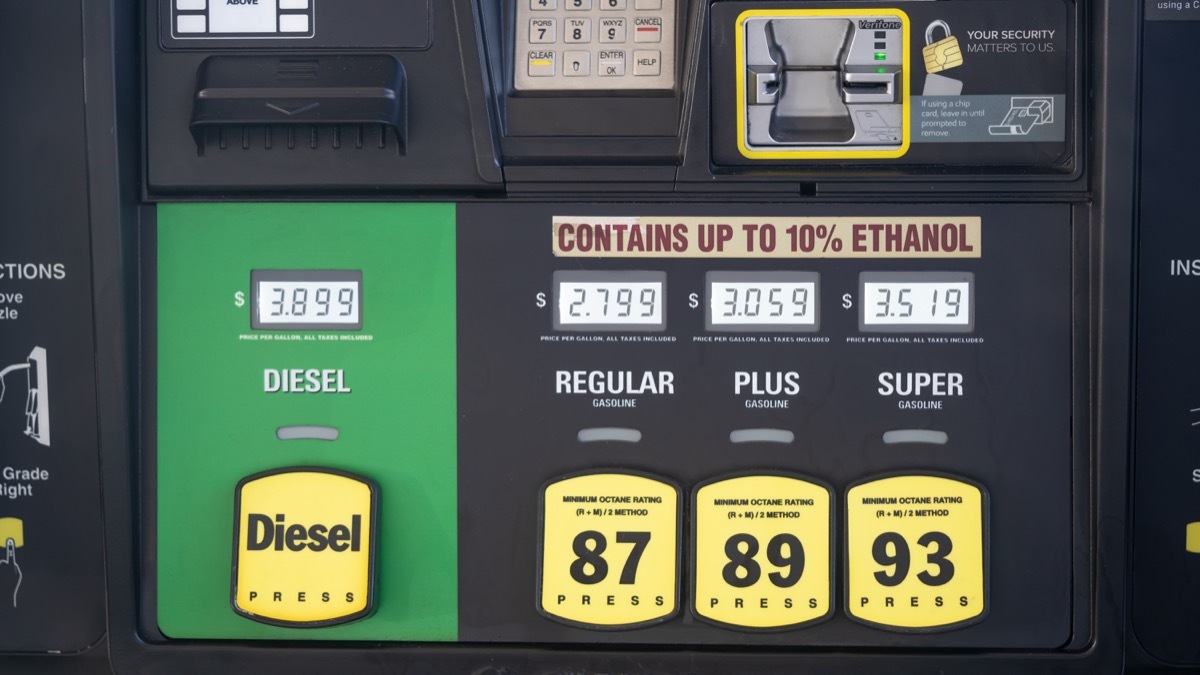

With credit card foams, crooks often try to get as many victims as possible without being taken. They "will generally install skimmers in places with a high volume of transactions but limited supervision". Andrew Latham ,, Certified financial planner With Supermoney.com, explains. This includes service station pumps and public transport ticket machines. AE0FCC31AE342FD3A1346EBB1F342FCB

"Usually, gas pump skimpers are placed out of sight of the station administrator," Bill Ryze , certified approved financial consultant and advisor to the board of directors of the Fiona financial services company, note.

ATMs are also a popular objective for credit card foams, "in particular those who are not located in banking branches", according to Amishav.

"Although retail stores and restaurants can also be involved in scams on scams, the chances are less because the terminals are generally under direct supervision of staff," adds Ryze.

In relation: 5 credit cards that will save you money on gas, say the experts .

How do the skimmers of the credit card work?

It is estimated that the skimming devices fly more than a billion dollars Financial institutions and consumers each year, according to the Federal Bureau of Investigation (FBI). But how exactly do skimmers give access to your information?

"When a credit card is slipped through a skimmer, the device reads and saves the integrated data in the magnetic strip of the card. The band contains the name of the card holder, the card number, date of 'Expiration and the CVV code, "explains Amishav. "Some more advanced skimmers also capture the user's pin if it has entered a compromise keyboard."

The criminals will then take this information and use it for themselves, or will sell it to others for a profit, according to Jonathan Feniak , A financial expert And avocado authorized to practice both in Colorado and Wyoming.

"Once the crooks have this data, they can use your card for all kinds of purchases, especially online, where they can enter your data with a few keys," shares Feniak. "" They can even make counterfeit cards which are essentially a copy of the original in your wallet. ""

7 ways to spot a skimmer from the credit card

"Card foams are not always easy to see, which is why fraudsters have been able to steal more than a billion dollars per year", " To mark ,, accountant, lawyer , and founding partner of Wyoming Trust and LLC lawyer, warns.

However, this does not mean that all hope is lost. There are several red flags which could indicate that a payment terminal has been compromised. In fact, here are seven different ways to spot a skimmer from the credit card.

In relation: 5 ways in which your credit card ruins your finances .

1. Gitch the card reader.

The first thing you should do before using a card player is to make it vibrate gently, according to Latham.

"A loose adjustment could indicate the presence of a skimmer," he said.

If the card reader moves or if you can remove all the pieces, do not use the machine and do not have an employee.

"Authentic card readers are robust and do not stand out quickly," confirms Ryze.

2. Search for other oddities.

A loose adjustment is not the only sign revealing falsification. According to Amishav, other quirks that may indicate a skimmer of the credit card could include "poorly aligned parts, sticky residues or discoloration", according to Amishav.

"If the terminal in question seems different from the others nearby, this could indicate falsification," he warns.

You must also check the shape of ATM card readers before using them, according to the FBI. The agency indicates that a normal card reader is generally concave, which means that it curves inward. Scammers, on the other hand, tend to bend outside in a more convex form.

3. Feel the keyboard.

If the real card reader is not compromised, the keyboard could be. So make sure you are attentive to that too.

"Sometimes criminals add a false keyboard on the original to capture the pins," said Amishav. "If the keyboard is thicker or spongier, proceed to caution."

4. Check the cameras.

Scholars can use a hidden camera next to the skimmer's device to save customer pin numbers, according to the FBI. These cameras are generally hidden on the front of a machine or somewhere nearby, such as a luminaire.

In this spirit, Latham advises readers to "keep an eye on all the holes or suspicious objects that could hide a camera aimed at recording spindles".

In relation: The police reveal how to "feel" the gift cards to avoid being scammed .

5. Use the Bluetooth of your phone.

Your phone's Bluetooth function may be able to locate a skimmer if the device diffuses a signal to transmit stolen data, according to Latham.

"Activate Bluetooth on your phone and scan devices nearby," he recommends. "Skimmers can appear as names of unusual or unknown devices in your Bluetooth settings, often as a chain of figures and letters."

But if nothing appears, this does not guarantee that the payment terminal has not been compromised.

"Although this method can indicate the presence of a skimmer, it is not infallible because all skimmers do not use Bluetooth and other devices can also show similar identifiers," warns Latham. "Combine this technique with physical checks from card readers and vigilant observation of your environment."

6. Take note of the terminal tapping technology.

Wes Kussmaul , A Expert in cybersecurity and confidentiality Who founded the Authenticity Alliance, suggests tapping your card instead of sliding it to prevent crooks from accessing unacyed information in your magnetic strip.

"Tapping uses AC technology, which generates a single encryption code for each transaction," he explains. "It makes it almost impossible for fraudsters to steal information from your card."

But the lack of payment for this form of payment could also help you more easily identify a skimmer of the credit card.

"If a payment terminal has a TAP icon but the tapping does not work, it may have been compromised by a skimmer", shares Kussmaul. "In this case, it is particularly important not to resort to slide the card."

7. Watch out for a broken security strip.

Given that service stations are one of the most common targets for credit card foams, employees will often place adhesive tape or stickers on the panel of each pump as "additional safety measure", According to Ryze.

"If you find these stickers torn or broken, I advise you to resist the use of the card reader," he urges.

You can also see the word "empty" on one of these labels if the pumping panel was opened ", which means that the machine was falsified," according to the Federal Trade Commission (FTC).

In relation: 5 largest scams per mail right now - and how to stay safe .

What can you do if your card has been skimmed?

The use of credit card skimmers continues to grow quickly in the United States recent report According to the data analysis company, Fico said that there was "a significant increase in compromise cards resulting from the skimming activity" last year, the total number of compromised flower cards in particular the 96% increase compared to 2022.

"If you think your card has been skimmed, it is important to quickly mitigate potential damage," said Latham.

Most financial institutions will give you 60 days to report any fraudulent activity and avoid responsibility, according to Paige Hanson ,, Digital consumer safety expert and co-founder of Securelabs.

"Regular surveillance of your transactions is therefore crucial for early detection," she notes.

If you see unauthorized transactions, signal them immediately to your establishment. You must also contact the FTC to deposit an affidavit of identity theft.

"This officially documents your case and helps new protections," said Hanson.

But even if you do not notice any unauthorized transaction, you can always contact your bank to report suspected fraud "if you are afraid of having inserted a card in a skimmer before making it," shares Pierce.

"They will deactivate your card and send you a new one for more peace of mind," he said.

Still worried? "Also plan to change your pin and online bank passwords to improve your safety," suggests Latham.

In relation: 5 times, you must cancel a credit card, according to financial experts .

Wrap

This is everything for our guide supported by experts on how to identify a skimmer from the credit card so that you can protect yourself and your funds in security. But be sure to check soon with us for more security advice that can make all the difference when it comes to protecting money in your accounts.

In relation: For more information, register for our daily newsletter .

Here's when you should visit the 15 most popular national parks of America