3 major social security changes in 2024 and how they will affect you

There are ramifications for those who collect and for those who do not.

You usually want Your finances Staying as stable as possible, but social security is not exactly the course. According to The mad heterogeneous , the social insurance program will undergo a number of changes next year. Some of the planned updates are positive and suggest that inflation can slow down. Others, however, can be more frustrating, especially if you are still retired. Read more to discover three major social security changes in 2024 and how they will affect you.

In relation: 5 secrets on your social security services, according to financial experts .

1 There is a higher earning ceiling.

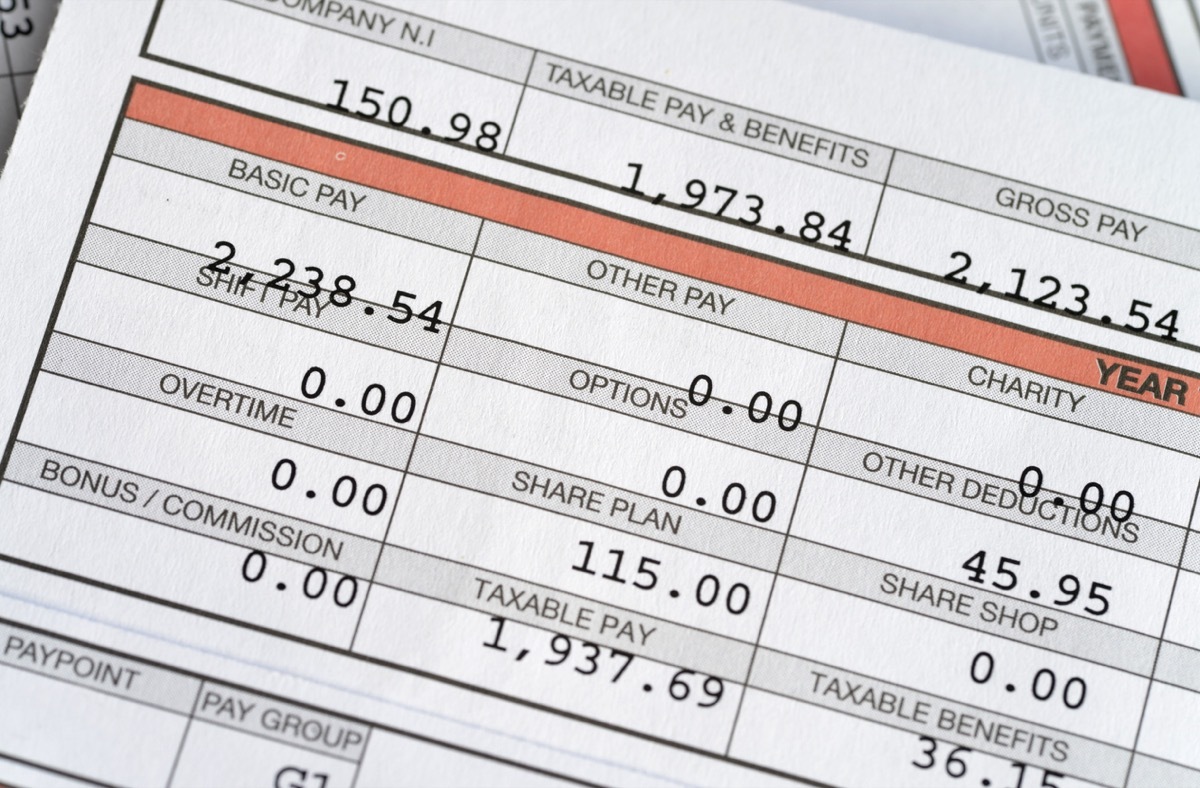

The US government is funding social security by taxing earned income. According to figures from Social Security Administration , workers from legitimate companies pay 6.2% of their salary earned in social security taxes, while employers pay 6.2% others. (Self -employed workers pay 12.4%.)

These taxes only apply to a certain salary ceiling, which is determined each year. In 2022, this ceiling was set at $ 147,000. In 2023, it increased to $ 160,200. But in 2024, he will jump even more at $ 168,600. In other words, if you earn more than $ 160,200, expect your social security taxes to increase a little next year.

Any income above $ 168,600 will not be reached by the tax on social security.

In relation: The IRS announced all these changes to your taxes - will you have assigned yourself?

You cannot collect Social Security before your retirement.

You cannot collect social security checks before officially retirement, and the payment levels you can receive depend when you choose to retire.

You can technically take your retirement and start collecting social security payments at 62 Social Security Administration .

If you were born between 1943 and 1954, your full retirement age is 66 years. If you were born after 1960, you will have to wait until 67 years. Finally, if you choose to wait up to 70 years to receive advantages - taxation of the year of birth - your payments will be 8% higher than if you start to collect at 67 years.

But there is a catch with regard to the changes for next year ...

In relation: 10 things you should stop buying your retirement, finance experts say .

2 Work credits will have a higher income threshold.

To win social security payments in the first place, you must accumulate 40 work credits during your career at a maximum of four a year, according to The Motley Fool. Here's how it worked in 2023: each $ 1,640 of wages that you earn each year corresponds to a credit. In 2024, however, you will have to win $ 1,730 per credit.

For full -time workers, either on a salary or salary basis - to hoist the annual work limit in 2024 should not be a problem. But part -time employees and concert workers may have more difficulty reaching the threshold. It could be worth doing mathematics to see where you fall into the mixture. AE0FCC31AE342FD3A1346EBB1F342FCB

3 Social security benefits will increase.

Now, for good news: if you collect a social security check, it will be a little bigger next year.

Since the early 1970s, social security payments have increased in accordance with the cost of living (or Colas) adjustments. General thought is that inflation guarantees that everything you pay - clothes and grocery store at gas and housing costs - will become a little more expensive each year. Colas guarantee that social security payments follow the pace of these additional costs.

Next year, payments will increase by 3.2% due to the colas. Although it is not as high as the amazing 8.7% of 2023, the Motley Fool notes that it is a sign that the inflation crisis in recent years finally takes a little.

However, we are still not quite return to the average: the Targets of the federal reserve An annual inflation rate of 2%. When we reach this point, we will be considered "normal".

In relation: For more information, register for our daily newsletter .

Best Life offers the most up -to -date financial information for high -level experts and latest news and research, but our content is not supposed to replace professional advice. Regarding the money you spend, save or invest, always consult your financial advisor directly.

The verification of your credit scoring could predict a diagnosis of Alzheimer