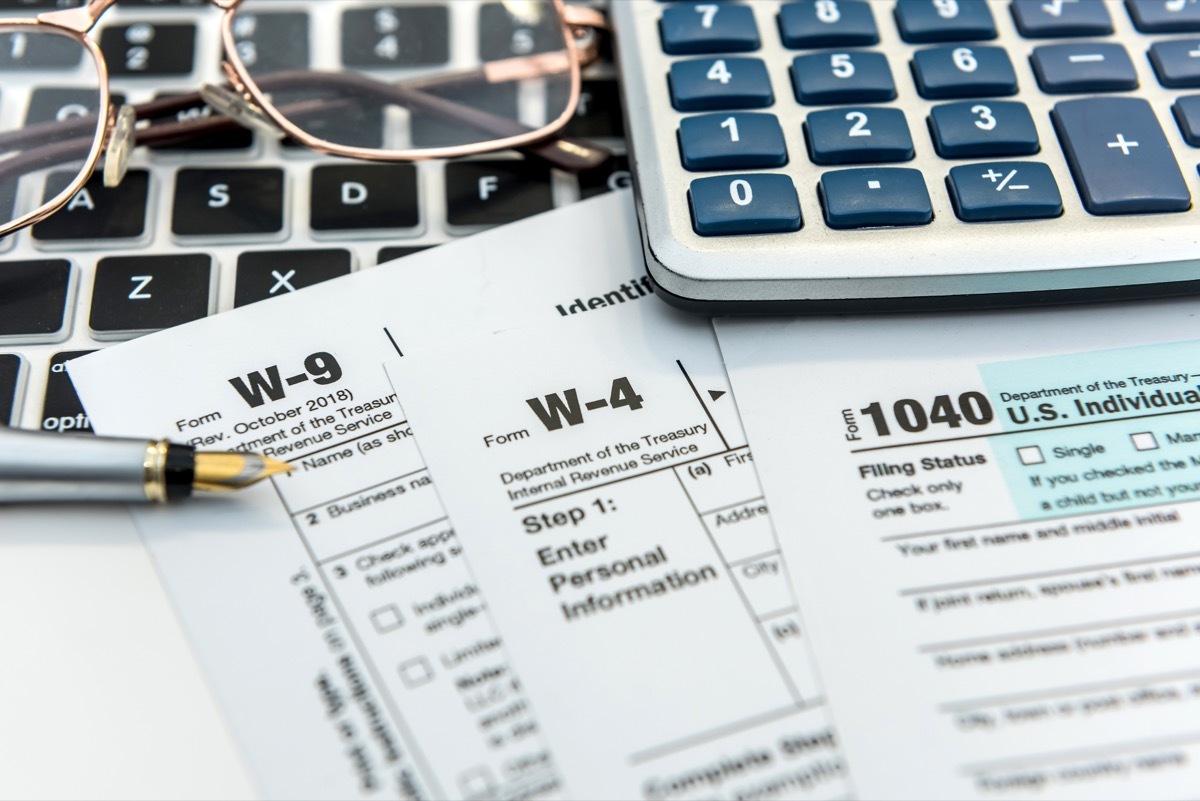

5 reasons why the IRS could undertake you by mistake, say the experts in finance

Do you get a call from the tax agency during your declaration?

Gathering your taxes may not be the easiest thing to do each year, but it is undoubtedly one of the most important. In addition to depositing in time, it is also essential to avoid errors and do not forget to include all the necessary information. Fortunately, there are a lot of Software options And services that can make the process a little more effective, but even if you get everything good, you could always find yourself under the government's investigation if you are not careful. Read the rest to discover five reasons why IRS could mistaken you in mistake.

Read this then: If you have already made your taxes, you may need to produce a modified declaration, IRS warns .

1 You have reported a lot of cryptographic transactions.

Whether it's buffering in Bitcoin or going strongly to Ethereum, cryptocurrency has become a popular addition to investment wallets in recent years. Blockchain -based funds have even become easier to buy thanks to new features on different applications , making the barrier at the relatively low entrance.

But as an emerging field in finance, the crypto can also draw the attention of the authorities when the time comes to deposit your taxes.

"As this is such a new form of income and not yet to report standards, the IRS is everywhere in addition to cryptocurrency reports", explains Moira Corcoran , A accountant and tax expert at Justanswer.

However, this does not mean that you should abandon your wallet. If you have invested in cryptocurrency, it can help if you have hired an accountant with expertise in the region, says Corcoran.

2 You have decided to deposit by paper.

There is no doubt that the deposit of your taxes electronically comes with A lot of advantages . In addition to allowing you to use software, experts say that this can also reduce the time necessary to obtain possible reimbursements and get ahead of problems much more quickly. The deposit by paper can also create the type of human error which triggers an audit.

According Jon Gassman , a certified public accountant and a financial advisor to Prager Metis , a former client had a problem when filing a modified return with printed forms due to its complexity.

"When the IRS key struck the return, they added an additional figure that resulted in a revenue shift," he said Better life . "Since the audit was in person, it was easily determined what was the problem when we shared and compared the information. But unfortunately, the IRS wanted to examine many other problems in the declaration."

Read this then: The reason n ° 1 that you could be audited by the IRS, warn the experts .

3 There is an error on your 1099.

Depending on the types of income you provide each year, your deposit may include different types of declaration forms. Merryists probably know the 1099, which can be used to report wages or advice paid by a company to an entrepreneur.

Juggling with many of these forms can sometimes make the filling of your forms a little more delicate. But even if you are cautious between your own information, there could be an error on the company side that paid you.

"Have you obtained a 1099 that was incorrect? If so, it could lead to an audit even if you have reported everything correctly," said Robert Farrington , founder and CEO of The college investor . "The key here is that the IRS might think that you have not done so and audit you accordingly."

For this reason, it is always preferable to dismiss your 1099 by matching them with payments received throughout the year. In this way, you can cause problems before it is time to deposit, suggests Farrington.

4 You have a higher income.

Having higher income can facilitate a lot in life. However, those who rattle money each year are also more likely to be reported by the IRS for an increasingly inspection.

"All that is more than $ 400,000 per year puts you more at risk for an audit," explains Corcoran.

If you are worried, plan to hire a team of expert accountants who include your financial situation and can start your deposit to minimize problems, she suggests.

For more financial advice delivered directly in your reception box, Register for our daily newsletter .

5 You have taken too many deductions from others in your income tranche.

Any well -composed tax file will include at least a few deductions. Of course, going too far on radiation is never good if you try to stay under the radar. And even if you play safely, you can always find yourself audited depending on the quantity you earn. AE0FCC31AE342FD3A1346EBB1F342FCB

"The IRS compares your detailed deductions to taxpayers in the same income group," explains Lei han , PHD, certified accountant and associate professor of accounting at Niagara University . "If your claimed deduction is much higher, the IRS can report your return."

Han said Better life This is generally limited to complaints for charity contributions, home office fees, meals and entertainment costs, among others.

"Taxpayers who have claimed an income tax credit (EITC) in recent years have been submitted to a higher audit rate. For example, during the 2019 taxation year, the Audit rate of low -income taxpayers who said that the EITC was 0.77%, "it said it.

Best Life offers the most up -to -date financial information for high -level experts and latest news and research, but our content is not supposed to replace professional advice. Regarding the money you spend, save or invest, always consult your financial advisor directly.

Johnson's CEO & Johnson has just made this disturbing prediction on Covid

21 tips that improve your memory, according to doctors