6 money moves to do now

Start planning for next year now with these smart and simple strategies.

My friends and I said when it comes to enjoying our best life: "Live now. But save enough for tomorrow."

While autumn begins and you start making plans for your own "2017 2017 forecasts and beyond", put the chaos order by following these six simple rules of the best online life. Do you save enough for emergencies? For retirement? Do you spend each paycheck optimally? They could look like big questions, but with the good guidelines and tools, attack them can be simple and extremely satisfactory.

Start here, then discover the story that has changed thousands of lives: the essentials100 ways to live up to 100!

1 Rebalance your 401K

About 15% of the United States has changed the allowances of our 401k projects last year. This means money in the drain, if you stick with powerful funds. You must also make sure that the stockpiling ratio of your portfolio is logical for your age: when you get closer to the retreat, more than your money is expected to spend stocks towards the safer bond guarantee. Watch how your 401K funds have made over the past year; You may want to go to better artists. (Morningstar.com Prices All stocks and funds on a five-star scale.) Confused? You do not want to bother with rebalancing? Switch to a target date retirement fund, which will calibrate you for you.

2 Increase your savings

If you say, what savings?, You are not alone. 62% of Americans have less than $ 1,000 at the bank. This is unacceptable. You should have at least eight months of spending in a savings account. Open an online savings account with a strong interest and have an automatic deposit made from your paycheck. Work up to 10%. (In January 2016, Synchrony Bank and Ally Bank offer the highest interest rates - 1.05% and 1% April, respectively - and do not require minimum deposit.) To make the most of each day, do not miss this incredible list of40 things you should do in your 40s!

3 Invest in a low cost index fund

Do you think you can beat the market with inventory tips that hide in an obscure internet corner that you will find only? News Flash: You will not do it. Financial icons like Warren Buffett, John C. Bogle and Paul Munger All lawyers invest in an index fund: a largely diversified set of funds that follows a good part of the entire stock market. Which eliminates risks. Use a discount broker like Fidelity or Vanguard, which offer a wider range of indexed funds. Whatever you do, do not keep the majority of your money in the actions or mutual funds for your business, whose fees tend to be unreasonably high.

4 Set a deadline to get out of debt

The number one treatment for anxiety is to confront it in the head. So take a look at what you need on your credit cards, terrifying as could be. (A good tool to inform your complete financial image is Mint.com - You can connect all your credit cards and all your bank accounts and see exactly where you are money every month.) Use a debt repayment calculator Like the one on Bankrate and Karma credit to see exactly how much you pay in interest a year and how much you can save by paying things earlier. Define a deadline and hold it. In this way, you can spend the rest of your time enjoying these incredible50 things you have to do before dying!

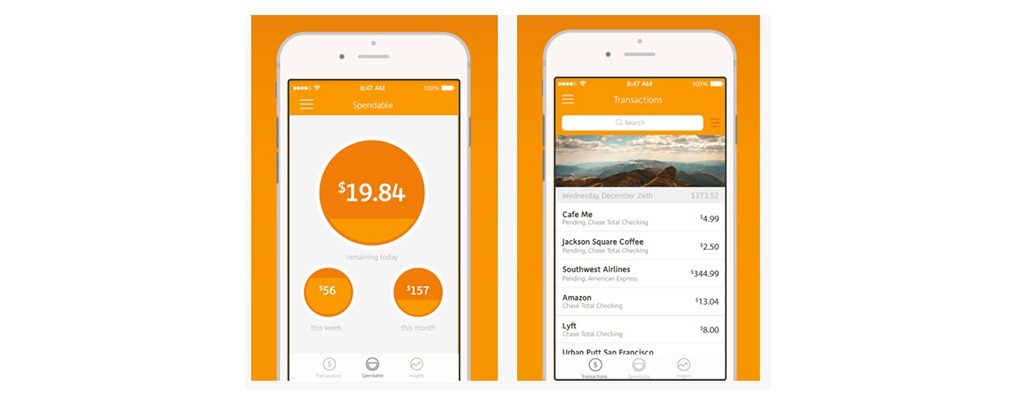

5 Cut shit

We all do it: eating too many times a week, let's go through a small country with daily Starbucks that runs, unfolding unimportant for an annual golf subscription rarely used. There are two simple rules on these minor expenditures and indulgences: they are never as minor as you think, and they can become major fast. Decide to cut the whole budget of your budget now. (Using a tool like mint automatically classifying each debit card scanning and check that writing facilitates the cup of fat.) An easy and painful place to start: this could be the year To finally cut the cord. Streaming broadcasting services like Hbogo and Hulut are likely to make your cable bill seem to swell.

6 Fire fire your life

During an era of reduction and reorganization of constant corporate costs, no person work is safe. And do you really want it? Entrepreneurship is the path of the future; Always be ready to hit alone. Renew your LinkedIn profile with updated information and a Pro photo. Write the outline of a business plan - or at least one lift plot - for you Inc., even if you do not think it will use it. You may find that putting your dreams on paper could lead to a lucrative future that you have not fully envisaged. You will feel a weight raised, have this security - and while you are there, turbocharge your happiness with these 25 ways to be happier now !

To discover more incredible secrets about the life of your best life, Click here To register for our free daily newsletter!