Man has looked for 6 million dollars in Covid loans with fake companies "games of thrones"

A man used his knowledge TV for helping coronavirus relief.

Everyone is desperate for a little extra money these days, people who havelost their jobs because of the pandemic Companies that try to stay afloat after Lockdown months. In March, the Government announced the Payrol Check Protection Program (PPP), providingSmall businesses with funds To cover eight weeks of payroll, allowing up to $ 659 billion to job retention and other expenses. But some people seem to have a little gourmet with respect to these PPP loans. A North Carolina man is now in legal difficulty after looking for coronavirus relief funds using false companies named afterGame Of Thrones.

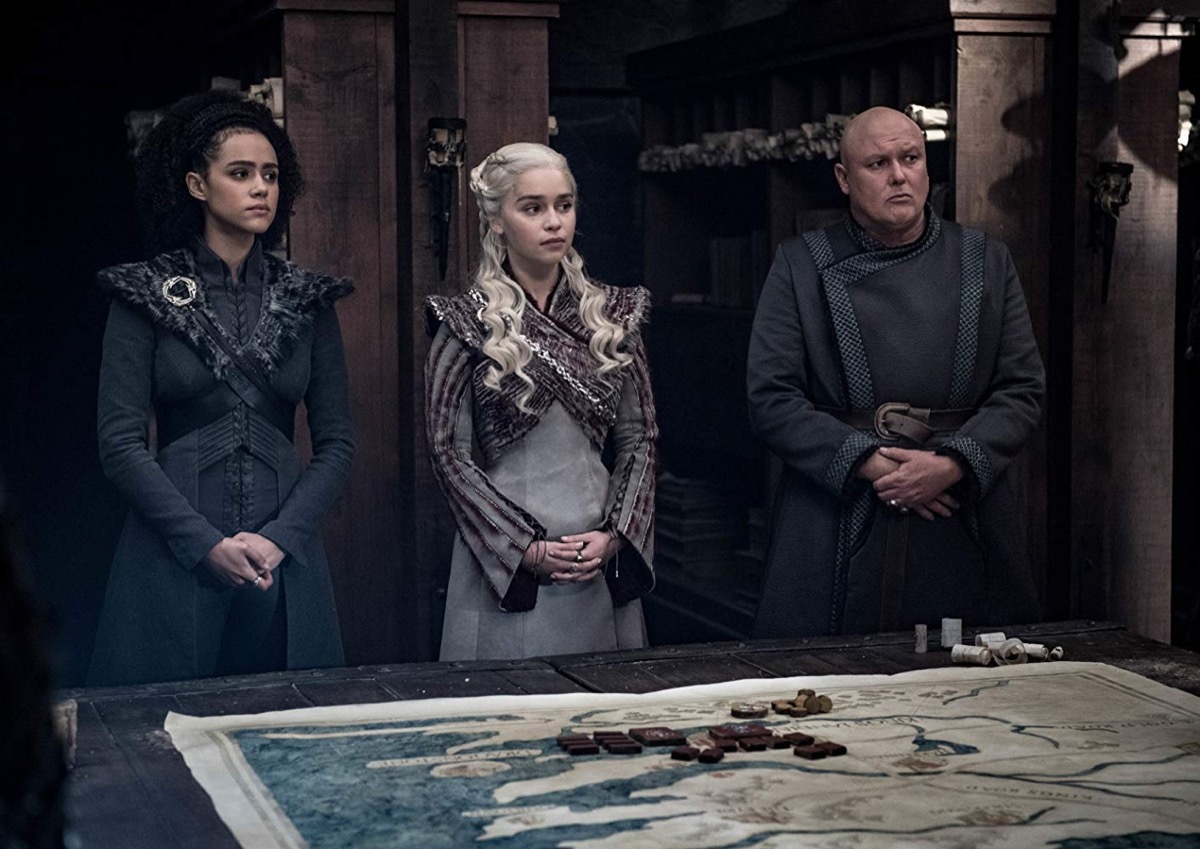

Tristan, a 38-year-old man living in North Carolina, would have askedPPP loans of more than $ 6 million misuseGame Of ThronesAccording to White Walker, White Walker and Khalesi, Based Based Walker, as well as a false panoramic insurance agency company, according to the Ministry of Justice.

PAN would have submitted 14 PPP loan applications for more than $ 6.1 million in Coronavirus Help and had received $ 1.7 million through approved loan applications for Fictional Pan Insurance and Walker Walker , LLC. According to his indictment, he made "false declarations on employees of companies and payloads", which was apparently supported by "false documents, including fasive tax deposits".

PAN has since been charged with wired fraud, banking fraud and illegal monetary transactions after an investigation by the Inspector General of the General Treasury Inspector for the Tax Administration, the Office of the Inspector General of the Inspector General , and the FBI, with the help of the small business administration office of the Inspector General.

RELATED:For more information up to date, sign up for our daily newsletter.

These PPP PP loans are looking forhave been created through the Cares ActFederal law adopted on March 29 to help provide emergency financial assistance to millions ofAmericans facing economic suffering Following the coronavirus pandemic. A source of coronavirus lightening of the Cares Act is the PPP loans, which companies must only use "the costs of the payroll, interest on mortgages, rent and public services", according to the Ministry of Justice.

But the pan is not the only one who has been accused of illegallyTry to secure coronavirus relief. During a press conference of September 10, Attorney General AlternateBrian Rabbitt says that more than 50 people would have tried to commit fraud toNet of more than $ 175 million from the Cares Act through PPP loans. He added that the actual loss was greater than $ 70 million.

"PPP funds were intended to help US floodless businesses. They were intended to help ordinary Americans and every day pay their bills and put food on the table," said Rabbitt. "The money that these defendants have stolen taxpayers' money; every dollar received was a dollar from the story of the American people. Worse still, every dollar they had taken was a dollar set aside to help our compatriots at One of the worst national crises of recent history. "But if you are looking to make money in good way, checkThis is the state where you can do the most money.