If you miss money from your stimulus payment, check this now

Some Americans report that they have received less money than expected.

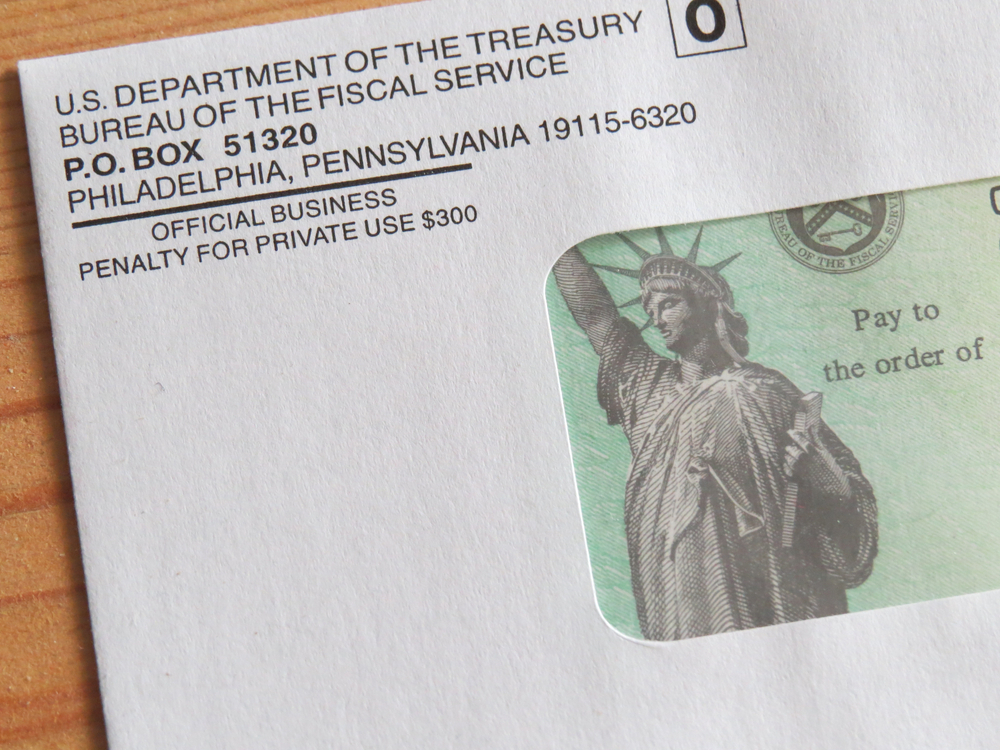

During the last week and a half, the Americans of all the United States haveReceived their third stimulus check. As of March 17, the IRS announced that there was alreadySent 90 million stimulation payments. Many people still wait for their checks, however, and there is also a chance that you have received money, but not the total amount you expected. Read on how to know if you are missing money from your stimulus payment, and if you have not acquired so far,This may be the reason why your stimulus check is always delayed.

Some Americans have only received half of the payment of stimulus they expected.

Several local points of sale have recently reported that many Americans claimed to have only receivedHalf of stimulus money that they expected - particularly in the case of families with two income employees. The phenomenon is quite widespreadgenerated a Facebook group"Half Stimulus missing / status status", which has more than 6,800 members on March 22. For more stimulation tips,If you wait for a stimulus check, read this before depositing your taxes.

Check your IRS payment status if you have not received all the money you expected.

Some members of the Facebook group noticed that there could be a chance of you and your spouse can receivehalf of the stimulus at separate times. A user has advised common statements to check the IRS "" "Obtain my payment"Tool twice, once with the social security number and the date of birth of the spouse, then again with the information from the other spouse. Several members of the group reported that the state of payment of a spouse indicated a later date, with many reports from the date on March 24.

Kags-TV, a new SNBC-affiliate news chain, indicates that even if youChecked your payment status earlier And he indicated that the two spouses should receive their check on the same day, you should check it again, as some people reported that the date on which one of their payments had changed. In addition, if you are a couple with a dependent who has jointly filed, some people report that the $ 1,400 per dependent have appeared divided between the two registrants. So a couple who expects this total of $ 4,200 can receive two separate payments of $ 2,100 to $ 1,400 for each spouse and $ 700 for half of the dependent's stimulus.

The IRS has just announced that they were sending another batch of stimulus controls this week.

On March 22, the IRS announced that they sent theNext set of the third stimulus payments this week. "For taxpayers receiving a direct deposit, this batch of payments began processing Friday and will have an official payment date of Wednesday, March 24, with certain persons who see them in their accounts earlier, potentially as provisional deposit or Waiting, "said the agency in his statement. "A large number of this last batch of payments will also be sent by the post office, so that taxpayers who do not receive a direct deposit before March 24 should monitor the mail carefully in the coming weeks for a paper check or a card. prepaid flow, known as the Impact Payment Card or EIP card. "And for more reasons for reasons why your payment could be retained,Your stimulus check can never come if you do not do it, IRS says.

There may be another reason you received less money than you expected.

Many taxpayers may not have understood that income requirements have changed for this third payment of stimuli. According toThe New York Times, PresidentJoe Biden agreed with stricter income limits For this series of stimulus controls. The IRS says that, because of this change, "some people will not be eligible for the third payment, even if they received a first or second" Payment of Stimulus. The attached registrants will begin to see their payments reduced if they earn $ 150,000 or more and any torque producing more than $ 160,000 will be ineligible for a check. And for passing missing payments,If you have never had your last stimulus check, the experts say that now .

Safeway has accused of encouraging buyers to pay "much more"

6 Sexy Zouk (Lambazouk) Dance Videos You Won't Stop Watching