52 ways to be smarter with money in 2018

Here's how to completely restore your finances in the next year.

Admit it, even if you have been an adult for a long time, have a car and a house - and maybe even have a 401K Roth and regularly contribute to a savings account, you still have no clear idea about the way of managing your money all its full. We are here to change that right now.

The key to improve with money is to realize something crucial: it is not an unfathomable mystical science for the average Joe. It just takes due diligence and a desire to learn. Hope this expansive list of all things-financial will make you motivate to buckle and get your money in control and work for you. And for more good financial advice, check5 millionaire money strategies that you can use.

1 Automate your savings

Simply create a predefined amount to access your savings each month (most experts suggest about 20% of your monthly income) or use a service or application asFigure WhereQaptial Save a painless effort attempt. Applications will automatically deduce small amounts from your account and will rest in a savings account for you.

2 Set a savings target

You are more likely to hit small short-term goals than more important and long-term goals, create a timeline that works for what you wantin two years Or so. Automatic transfers to save can help with this and seek a savings account offering a high rate of return as a credit crate or money market account. And for more good money saving advice, here is theBest way to buy real estate.

3 Invest in a plan 529

If you have children and you suppose they will want to go to college, create a 529, which is also called a "qualified tuition plan". This savings plan is sponsored by a state or state agency and you can contribute up to $ 70,000 ($ 140,000 for married couples) per beneficiary without being submitted to the federal gift tax. And remember: you can save money every day with these18 Secret sellers do not want you to know.

4 Budget

Choose a budgeting system and follow it. We recommend the 50/30/20 solid budget, which translates by 50% for necessities, 30% for luxury or desires, then 20% in savings or repaying debts. But take easy: there is no need to enter the nitty-gritty, depending on each century spent - as long as you live in your means and are on track to make your goals.

5 Buy cars with money

Unless you can get a very good loan with a large interest rate (as close to zero), that you should consider paying cars with money. There will be a little, lower your expectations a bit and prevent you from flinging on more car than necessary and you only pay the value of the long-term car. And if you are looking for a new trip that will not break the bank, these are the10 best new cars under $ 30,000.

6 Live below your means

This one is simple in theory, but can be difficult to do in practice. Basically, you just need to follow your finances for a month, then adjust your expenses to what happens. This is not rocket surgery, to be sure, but difficult to stick when holidays, holidays or emergencies appear. And for larger career tips, read about the15 Warning ways to transform bad business ideas into good.

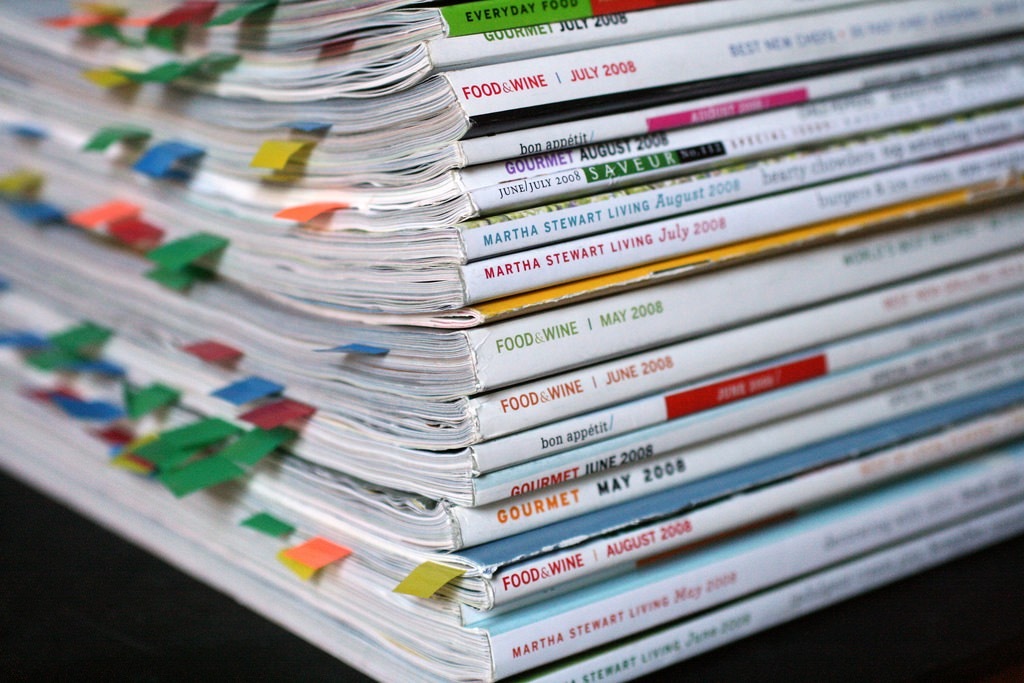

7 Subscription scale

In the era of any digital, it is a good time to re-evaluate your cost of consumption from the media. Do you even read these monthly magazines or simply recycle them every few weeks? Compare your multimedia-print and digital subscriptions - and cancel the ones you stopped. Pro Adapter: If the press release that you like a paywall, you can usually always read the content if you click the official Twitter account of the output.

8 Revaluate subscription services

In the same tip, perform the same subscription audit for all video services you use. Do you really need subscriptions on Netflix, Hulu, Amazon Video, Showtime and HBO? Follow your observation habits for a month, including how much you consume cable TV and get rid of the losers. And change your thinking habits too, consider the5 ways of thinking differently than most people.

9 Automate invoice payments

You can easily avoid billing fees while removing the monthly stress of paying bills by automating everything. You can simply configure it via your bank and that you charge a fee, but make sure you come back from time to time from time to time for hidden costs that sometimes appear. Bonus: You will cut the stress to immediately get the maiders of your life.

10 Jump

Try to free yourself from the hardware desire and buy what you value, and do not covet the last big purchase of your neighbor. You do not know their finances and how (or if) they are able to pay this new BMW, so it's better to stay with your budget and plan.

11 Make an additional mortgage payment

Reserve an additional monthly payment each year on your mortgage or car to shorten the duration of your note. If you have a $ 200,000 loan for 30 years with a 5 percent interest rate, it would cost you $ 186512 in interest on 12 annual installments, but add an extra each year and the loan will be refunded four years earlier And you will save $ 32699 interest.

12 Pay more than the minimum

If you wear credit card debt, pay only the minimum every month, even bearing just a big could take years to pay if you only submit the amount of the bottom of the rock because of each month. If you have multiple cards, pay the minimum on the lowest, but put everything you can up to the highest until it erased.

13 Maximize your credit score

To keep a strong score, your credit utilization rate or debt compared to the amount you have available for credit, below 20 percent and not greater than 30 percent. The better for your credit score, but do not have it at 0 percent.

14 APPLICATIONS SPACE Credit Card

Wait at least six months between credit requests to increase your chances of approval. If you have a very good score, make a lot of money, and always pay in time though, you can apply more frequently for more cards because businesses want your business.

15 Good debt keep

There is such a thing as "good debt", and it includes taking a mortgage to buy a house or take student loans to pay for the college. A car payment can be a good debt if the vehicle is used for your business, but it is usually not that they lose their value so quickly. It is essentially a loan that pays for things that will increase value or increase your earning potential in the future.

16 Employer Match 401 (K)

Make the most of your 401 (k) pension fund if your employer offers counterpart funds by fully contributing to the Fund. This is essentially the free money of your employer and can help maximize your pension funds.

17 Contribute

Do not match exactly what your employer gives you. Or if you are self-employed, make sure you try to put in the maximum as you can depend on your age. For less than 50 years, you can put in $ 18,000 a year; If you are over 50, you can pay up to $ 24,000.

18 Manage lifestyle inflation

Know that if you start making more money, you will probably start spending more, unless you are financially aware. Going from the larger and more expensive apartment because you make more money, you end up losing on your ability to create wealth.

19 Shop for better savings accounts

Do not just park all your money in an account to your local bank with its meager 0.06% interest rates, look for online savings that can pay up to 1 percent. Online banks likeAlly (1.25%),Synchrony (1.30%), andAlloying(1.25%) can make your savings do a little more for you and less for the bank.

20 Start now

It's easy to lament does not start your retirement fund or the creation of an automatic savings account when you were young, but you can still get some advantages in the future if you startat the moment. Like the investment guruWarren buffet said, "Someone sitting in the shade today because someone planted a tree a long time ago. »

21 Buy stockings, sell high

This seems to be a fundamental rule of the good investment and finance, but many people do not know this advice every day. At the moment, it can be very difficult to say if a price is actually weak or high, but a good basic rule for the stock market is to buy when fear is high recession and sell when greedy greed when l 'expansion is event.

22 Chat

Another buffet jewel: "Ignoring chatters, keep your minimal costs and invest in actions as you would on a farm. This simply indicates that you need to treat the stock market as real estate and continue to think about the long-term potential of profits, not an irrational behavior of other stockowels that report volatile fluctuations.

23 Invest in what you know ...

... and nothing more more about timeless tips from Warren Buffet (it's only the third most rich man in America, so maybe he knows what happens). Be careful when you think about investing in complex industries or businesses that you do not know anything; Try to stay with the areas you understand or can enter after searches.

24 Invest in quality

Do not invest in the companies that undermine the quality - the integrity of the product usually reflects the organization and priorities of the company. Successful, well-made and thought products often mean that the company will have an advantage on the market you should be careful.

25 Aim for the long term

A last buffet gem: "If you do not think about owning a stock for 10 years, do not even think of owning for 10 minutes." Change the prospect of your stock of purchase of "stock stock" to "invest in a business", like all good things take time. So plan to keep your investments for a long time.

26 Make a financial calendar

Throughout the year, there are significant financial obligations that appear, such as income taxes, land taxes or verification of your credit report, then make a schedule that has all your major financial events . Here is a goodmodel To start.

27 Conquer small debts first

When you have a debt mountain that confronts you, so it is better to start small and first eliminate the lowest quantities first. In this way, you can show yourself that it is possible and go to big debts will not appear intimidating.

28 Goal

Do not simply limit your goals to complete a savings account, you must also define certain goals for all your finances. When would you eliminate your debt? How long until your retirement goals are achieved? When do you finish your emergency fund?

29 Check your transactions daily

Do not undress your finances, but for some people who take a minute a day (that's all!) To check what's going on and going out can keep you over and help you notice inconsistencies or transactions Hinky.

30 Keep a trace of interest rates

It is also good to record interest rates from your credit card from time to time. You may have been on an introductory percentage rate that you have forgotten to a higher amount, or it may be time to try to negotiate with your credit card company for a lower rate. It's also a good time to think about a new news at a low pace and nix the upper cards.

31 Check on hidden fees

Credit card companies are notorious to slip at fees for some "benefits" such as discovery or protection of identity, in order to return to your statements to see what types of things they are nickel and you set. Keep the onto those you think about being valuable, but cancel the costs worthless.

32 Mortgage right

Here are two tips for making your mortgage gently: configure recurring payments and when you pay for a supplement, whether for a month or if you want to make an additional annual payment, make it clear for your lender. What is the payment for.

33 Check your credit score more often

If you plan to delete a loan or buy a home, it is important to make sure you have an acceptable credit score. There are three credit offices that maintain information about you and your debt - Equifax, Transunion and Experian - and their information builds your FICO credit score, which is a profile of your credit risk. There are many free online services now, like Credit Karma, so be sure to follow your place.

34 Buy experiences

When you decide to spend your money on big purchases, studies have shown that the purchase of fancy cars or expensive jewelry will not give you a lot of satisfaction in more time. But when you were studying for an incredible holiday or an adventure like Sky Diving, you savor the much more experience over time.

35 Pay a debt a priority

Debt can be disabling because interest payments go over time, overload the initial amount of money you spent. So, go to pay any debt an absolute priority. This gives you a better credit ratio (just do not pay all that; remember, it's good to wear a certain debt) and more attractive for lenders.

36 Do not save in the verification

Your current account should simply be filled with the money you need to pay your monthly bills and daily purchases, all that should be parked in your savings account because they offer higher interest rates overall . Try to keep an amount equal to a month of compensation in your current account at any time to give you a decent cushion to pay for expenses.

37 Delete discovery protection

If you have already composed a solid budget, you do not need discovery protection. Banks love it because they can dinger with silly fees, but for financial prudence, it's just another way for them to take your money.

38 Dispose bad habits

It looks like an easy and obvious tip, but it takes some self-awareness to be able to retreat and analyze your bad expenditure habits that break the budget. Try to eliminate them by spending only money, learn what triggers you to spend, taking a step back before making a purchase and glue to a list when grocery shopping.

39 Start emergency savings

You should allocate enough very liquid money type funds available from a savings or a current account - to help whenever an emergency, such as a sudden health problem or an unexpected tax bill, appears. Most experts say they have about three to six months of your hidden annual income.

40 Start emergency savings

Few people understand how a credit crate is different (and better) than a bank, so here is the low mode. A popular fund belongs to customers; A bank belongs to investors. Credit unions can often offer better offers because they are not concentrated on profit as much as a bank. But, as for all things, it's not always true, so check and see if a switch is right for you.

41 Sign up for an FSA

To maximize medical expenses, it is good to sign up for a flexible expense account (FSA) because the money you have put here will not be imposed. You can count up to $ 2,600 a year for the employer who can help pay the medical expenses for you and your spouse or dependents.

42 Reward you

If you save and if you budgeted and keep tabs close to all your finances, it's good to take a little bit of this money and make dancing on yourself. Now you should not go out and drop thousands on a new car; It looks more like going out for a fantasy dinner or buy a new gadget.

43 Do not add to your debt

That's probably without saying, but if you're trying to repay a big bunch of debt, do not continue to add it. This battery will not disappear if you are constantly or even once, buying more things on this card. Cut the card or keep it at home and accessible only to true emergencies.

44 Give yourself a mission

If there is a little financial burden that does not have you, do not continue sweeping it under the carpet. Give yourself a financial assignment to deal with the problem or task and make a due date. Take a little time one night and break down and start enlightening.

45 Look back

Every year, things happen that can affect the financial strategies you have already defined - a marriage, a new job or investment, so it is important to put aside a period when you go on everything to make sure it is Always on the right track and can identify points you need to edit.

46 Go for a budget 80/20

The 50/30/20 budget is a solid choice, but if you are not keeping a trace of expenses, try the 80/20. This budget simplifies and says you have set at least 20% in savings, then use the 80% more for all the rest - no need for micromania. If it works for you, try to push it further, up to 70/30 or even 60/40.

47 Invest in preventive care

Studies have shown that putting time and money in preventive care - joining a gym, get regular physical pieces, go to the dentist twice a year - can give you a5-to-1 return on investment. You stay healthier, which helps you, the company in general and your employer.

48 Test

If you do not have family or dependents, you do not really need to do a will. But if you care where your money and your assets will go after your death, you should have a workout when you reach 50 years.

49 All the money, all the time

To really stay out of debt and loan clutches, just spend money for everything. This can be prohibitive if you are not rich and try to buy a home or a new car, but for all other purchase, it's an IronClad way to prevent you from getting out of debt.

50 Reassess investments

Once a year, at least where every time a major change occurs in the economy, you should go back and check your investments. Inflation, volatility, interest rates and other change factors mean that you should always re-examine your investment approach.

51 Finance

Few households hold family discussions about finance, and it is not taught in many quality schools, so make sure you convey your knowledge. It is important to start early in the management of finances and savings and investment, so make sure your loved ones have a good financial base.

52 Do not save too much

You can save too much, tell financial advisors. For one, you could die early and not have time to enjoy your money, but more seriously, most people who are dilisers do not realize that once you retire, expenses like paying taxes and a retirement economy disappear. So check with a financial advisor and trace a safe way but also fun using your money. Once you decide to make fools on a getaway, this Secret will save you on air tickets .

To discover more incredible secrets about the life of your best life, Click here To register for our free daily newsletter!

The worst case of Dr. Faisci has just become reality for America