15 easy ways to stop wasting money

Stop wasting money with these easy tips and tricks.

One third of the Americans carry morecredit card debt at the moment they have personal savings, according to a 2019 report byBanking rate. And in addition to that, according to the newest of WallethubStudy of credit card debt Posted in December 2019, we just crossed a terrible stage: for the first time in history, officially owned American citizens of more than 1 billion yes $,a thousand billion-In the credit card debt. Certainly, we are collectively not so big with money. But if there is a lining of money, it is that you can become morefinancially responsible And today read and write. So, read more to find out howstop wasting money And start spending wisely.

1 Know that you should never pay full price.

Whatever it is clothes quite well, the food, the rental of movies,air tickets, Hotel rooms, you the name will, at one time or another,finish marked down. By paying the full price for anything, you get right in the wallet. Make sure you enjoy the special discount days likeBlack Friday andCyber Monday To really make the most of these chords.

2 Get a plus phone.

At present, a Samsung Galaxy S10 is sold for about $ 900, depending on the retailer. A Samsung Galaxy S9 for all useful purposes, the same phone goes for about $ 599. Similarly, the iPhone 11, if you buy it directly from Apple, starts at $ 700. The little more, the iPhone also functional XR sells at $ 600. Ask yourself: Do not have the last phone value spending extra money?

3 Invest in a health savings account.

For those who do not know, aHealth savings account (HSA) is a type of savings account in which you can deposit funds, duty-free, directly from your paycheck to pay medical expenses. And what could slip under the radar is the fact that, in many cases, you can use your HSA card to pay for a whole series of over-the-counter convenience store products, including a solution for contact lenses, Sunscreen, laxative, condoms, fertility of tests, bandages, hot fixes, shoe soles, and lip balm. You get the same products for the same price, but you get to pay them using pre-imposed money.

4 Set up a 529 for your children.

For those who are considering sending their children to the university, invest ina 529Or a "qualified tuition plan" is among the best shots save money out there. With this savings plan, you can allocate money franchise from your paycheck directly into the account for your children's tuition fees and other related expenses. Each state has its own laws on how much money you can contribute, and they can vary from $ 235,000 per beneficiary to $ 529,000 per beneficiary, according toInvestopedia.

5 Upgrade your streaming accounts to a family diet (and share with others).

Make an agreement with a brother or a friend to exchange yourNetflix password For their Hulu password, or vice versa. This $ 10 per month may seem pocket money, but over time, you save hundreds of dollars every year just sharing!

6 Instruct a mandatory waiting period.

Human impulse is a powerful creature, so beware when you overcome with an i-have-to-go-house-with-this-today the feeling of an expensive article. Wait two or three days and, if you still want, go back and buy. If the feeling has passed-hey, you have just been wasting money on evilling something you do not really like it!

7 Buy your clothes during the dead season.

As a cycle of clothing retailers along the seasons, they must get rid of the old merchandise to do for what's new. This means that swimsuits, skirts, and all short sleeves will be marked down October. Similarly, you can expect anything comfortable or puffy to have a price of the ticket reduced to the end of April. Of course, shopping with this means of the method you will need to avoid trends andFocus on the classicsBut the money you will save is worth it.

8 Optimize your electricity consumption.

When you leave the house or stop using something, be sure to turn it off or unplug it.NATURAL RESOURCES DEFENSE COUNCIL estimates that households spend, on average, $ 165 per year in electricity for the elements thatare not even used!

9 Get a new refrigerator.

Investing in an Energy Star EPA Certified Refrigerator can save you hundreds of dollars. For example, if you have an old French coast side model on the top, with a drawer freezer at the bottom-exchange for a newer version, the efficient energy model, and you can save about $ 150 a year . To learn more about how it affects you, the EPA has an easy-to-use interfacecalculator.

10 Get a clocked thermostat.

These intelligent thermostats could be expensive, but the extremities justify the means. According to research conducted by the high thermostat companyNest, Switch your regular analog thermostat on the nest always plugged in (or any other intelligent thermostat) can save you up to $ 145.in energy costs per year.

11 Pay more than the minimum.

The average American, according to Experian's2019 Annual Survey, is sealed with $ 6,194 credit card debt. Let's say your card has a standard interest rate (15%) and you make the standard monthly payments ($ 100). At this rate, it would take you120 months Pay the card. Bump These monthly payments up to $ 125, and you set a comparatively shorter 78 months, while $ 150 payments will bring you back to 59 months. Since the annual percentage rates (APR), minimum payments, etc. Can be confusing, consider consulting a credit cardDebt calculator for advice.

12 Dodge shipping costs.

WhateverCustomer frequent online Expected, shipping costs can stack high sky. But with a wishing eye and some dig, you can avoid paying them quite. For example, Crified & Barrel, Nordstrom and Menswear retailed-Vetakeer Bonobos offer all free shipping. And if you are ready and capable, you will find that most large-scale retailers (includingTarget) Offer a free shipping in a brick and mortar location near you.

13 Install honey.

Everyone loves a good discount. But when it comes to shopping online, job tracking can be like searching for a needle in a very disorderly hay hay. EnterDarling, an application that will find discounts for you. It's a Google Chrome plug-in that browsing the web for codes and when you check, automatically apply the uses applicable to your order. Ching!

14 Sign up for reward programs.

These days, most channels have reward programs somehow. And neglecting to sign a painless process that usually requires little more than your name and e-mail address - you are essentially wasting money by prevailing it. Some of the best reward programs includeTarget circle,Stubs AMC Insider, andCVS Extracare.

15 Switch to an ATM repayment bank.

Online banks, likeAlly, do not have ATMs. As such, they will pay for your withdrawal charges so that you can hit ATMs at any bank without having to rush on the fees of Pesky.

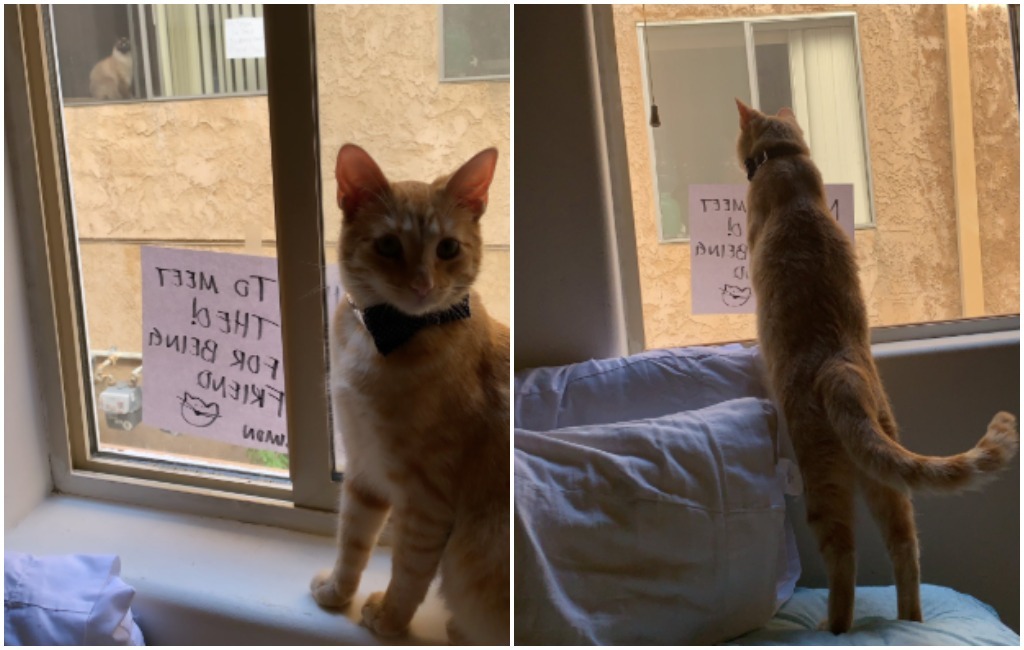

This story of viral love between two cats will restore your faith in romance